Understanding Cryptocurrencies

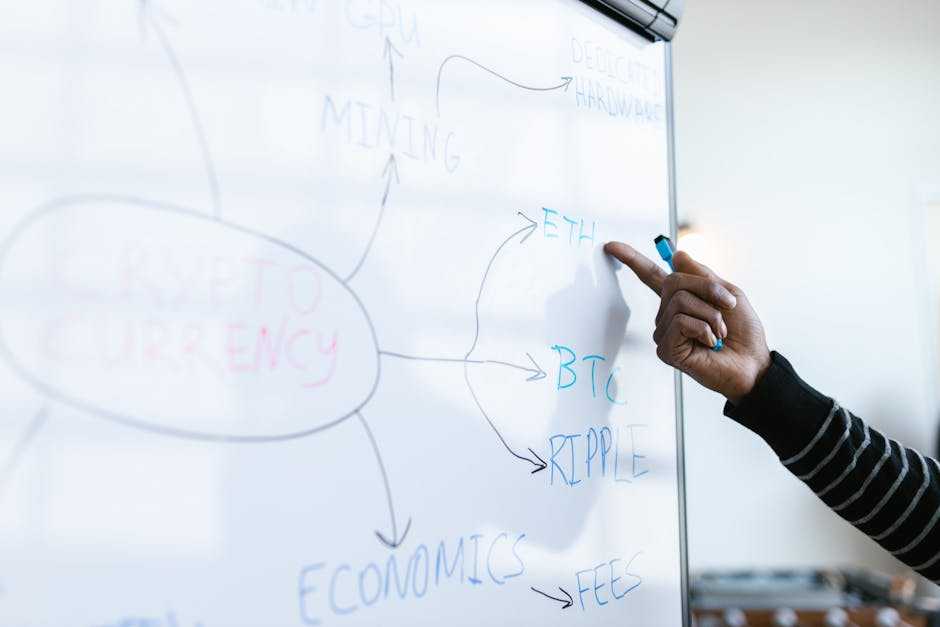

Cryptocurrencies revolutionize finance by providing decentralized digital assets based on blockchain technology. Let’s delve into the specifics of Bitcoin and altcoins.

What Is Bitcoin?

Bitcoin is the first cryptocurrency, introduced in 2009 by an anonymous entity known as Satoshi Nakamoto. It’s designed to facilitate peer-to-peer transactions without intermediaries using blockchain technology.

Bitcoin aims to serve as a digital alternative to traditional currency, offering transparency, security, and decentralization.

What Are Altcoins?

Altcoins refer to all cryptocurrencies other than Bitcoin. These vary significantly in purpose, technology, and market value. Examples include Ethereum, which supports smart contracts, and Ripple, designed for fast international transactions. Altcoins often address perceived limitations or offer additional features compared to Bitcoin, creating a diverse and dynamic market.

Market Dynamics

Market dynamics in the cryptocurrency space vary widely between Bitcoin and altcoins. Analyzing these factors can aid investors in making informed decisions.

Market Capitalization

Bitcoin, with its dominant market capitalization, leads the cryptocurrency market. Its cap often surpasses $550 billion, making it the most valuable cryptocurrency. Altcoins, however, collectively hold significant value.

Ethereum, the largest altcoin, has a market cap of around $200 billion, while others like Binance Coin (BNB) and Cardano (ADA) range in the tens of billions. A higher market cap in Bitcoin suggests stability, while altcoins offer growth potential.

Liquidity and Trading Volume

Bitcoin’s liquidity surpasses that of altcoins. It boasts daily trading volumes exceeding $100 billion, ensuring easy buying and selling without significantly affecting prices.

Altcoins like Ethereum and Tether (USDT) also exhibit high liquidity, with volumes ranging from $10 billion to $50 billion. Lower-cap altcoins may struggle with liquidity, resulting in price fluctuations for substantial trades. Bitcoin’s established liquidity provides a reliable market, whereas altcoins present varied experiences.

Price Volatility

Bitcoin sees substantial price swings, yet remains less volatile compared to many altcoins. Historical data indicates Bitcoin’s price can change by up to 5% in a day, driven by market sentiment and macroeconomic factors. Altcoins, due to lower market caps and specialized use cases, often experience higher volatility.

For example, smaller altcoins can witness price changes exceeding 10% daily. Bitcoin’s lower volatility may appeal to conservative investors, while altcoins’ potential for rapid gains attracts risk-tolerant individuals.

Adoption and Use Cases

Adoption trends and use cases for Bitcoin and altcoins showcase their growing relevance in financial systems and beyond. Each cryptocurrency has unique trajectories and varying levels of integration into mainstream platforms.

Bitcoin Adoption

Bitcoin, the first cryptocurrency, has seen significant adoption across different sectors. Many major companies, including Tesla and PayPal, now accept Bitcoin payments. Governments and financial institutions increasingly recognize Bitcoin as an asset. Bitcoin ATMs have also proliferated, with over 38,000 machines worldwide, making it easier for consumers to access and use their Bitcoin holdings.

Altcoin Adoption

Altcoin adoption varies widely based on specific use cases. Ethereum, known for its smart contracts, has become a cornerstone for decentralized applications (dApps). Ripple’s XRP has gained institutional traction for cross-border payments, with partnerships like SBI Holdings. Other altcoins, such as Cardano and Solana, focus on scalable blockchain solutions, attracting developers and investors interested in innovative technologies.

Real-World Applications

Real-world applications for Bitcoin and altcoins highlight their utility beyond mere investment vehicles. Bitcoin’s use in remittances offers a cheaper alternative to traditional methods.

Ethereum’s smart contracts facilitate decentralized finance (DeFi) applications, allowing users to engage in activities like lending and borrowing without intermediaries. Altcoins like Chainlink provide critical blockchain infrastructure, ensuring data integrity for various applications. These applications display the practical benefits and diverse functionality of cryptocurrencies.

Technological Differences

Technological differences between Bitcoin and altcoins influence their performance, security, and scalability. Understanding these differences helps investors make informed decisions.

Blockchain Technology

Bitcoin’s blockchain is simple and focuses on secure, transparent transactions. It relies on a decentralized ledger maintained by a network of nodes. Altcoins use varying blockchain structures.

Ethereum, for example, enables smart contracts through its Turing-complete programming language running on its blockchain. Ripple, on the other hand, uses a consensus ledger to facilitate fast cross-border payments. These different blockchain technologies provide unique functionalities and solutions.

Consensus Mechanisms

Bitcoin employs Proof of Work (PoW) to validate transactions, requiring miners to solve cryptographic puzzles. This ensures transaction security but consumes significant energy.

Many altcoins use alternative mechanisms. Ethereum is transitioning to Proof of Stake (PoS) with Ethereum 2.0, reducing energy consumption by selecting validators based on their cryptocurrency holdings. Ripple uses a consensus algorithm that relies on a network of validating servers, offering faster transaction confirmation at a lower cost.

Security Features

Bitcoin’s security features include decentralized validation, making it resilient against attacks. Its large network of nodes and miners adds further security. Altcoins incorporate diverse security measures.

Ethereum benefits from its large developer community identifying and addressing vulnerabilities quickly. Ripple’s unique consensus algorithm prevents double-spending and ensures integrity without a massive computational workload.

Additionally, altcoins like Monero focus on enhanced privacy features, providing anonymous transactions through obfuscation techniques.

Understanding these technological aspects reveals how Bitcoin and altcoins address scalability, security, and innovation in the crypto landscape.

Regulatory Environment

Cryptocurrency regulations vary greatly around the globe. Understanding the regulatory environment helps investors navigate the risks and opportunities.

Bitcoin Regulations

Bitcoin faces a range of regulatory approaches globally. In the US, the SEC classifies Bitcoin as a commodity. The EU treats it similarly, focusing on anti-money laundering (AML) laws. In contrast, China’s regulatory stance prohibits Bitcoin trading and mining. Japan recognizes it as legal property, promoting consumer protection. These differences impact Bitcoin’s market adoption and investor confidence across regions.

Altcoin Regulations

Altcoins encounter more complex regulatory scrutiny. For instance, the SEC views many altcoins as securities. Ethereum, although initially scrutinized, now enjoys clearer regulatory status.

Ripple faces ongoing litigation over XRP’s classification. Privacy-focused altcoins like Monero often face bans or restrictions. Regulatory clarity and enforcement vary, affecting altcoin mainstream adoption and regulatory compliance.

Impact on Market

Regulations directly affect cryptocurrency markets. Clear regulations boost investor confidence, enhancing market stability. Stricter regulations may hinder innovation but protect consumers.

Regions with favorable regulations attract more crypto businesses and investors. Regulatory uncertainty or harsh restrictions, like those in China, lead to market volatility. Understanding these impacts aids in better navigating the crypto landscape.

Investment Potential

Analyzing the investment potential of Bitcoin and altcoins involves understanding the associated risks and future prospects. Each offers unique opportunities and challenges for investors.

Risk Factors

Several risk factors affect cryptocurrency investments, with Bitcoin and altcoins exhibiting distinctive risk profiles.

- Volatility: Cryptocurrencies, including Bitcoin and altcoins like Ethereum and Ripple, experience significant price fluctuations. Bitcoin’s volatility impacts investor sentiment, while altcoins often show even higher volatility due to smaller market capitalizations.

- Market Manipulation: Bitcoin, despite its larger market cap, is not immune to manipulation. Altcoins, especially newer or less-established ones, are more vulnerable to price manipulation by whale investors or coordinated pump-and-dump schemes.

- Regulatory Risks: Bitcoin’s established presence has led to clearer regulatory frameworks in many jurisdictions. Altcoins face varied regulatory scrutiny, with some like Ripple experiencing legal challenges that impact their market value and investor confidence.

- Technological Risks: Blockchain technology, crucial for both Bitcoin and altcoins, isn’t free from cyber risks. Bitcoin’s network has proven robust, while altcoins, especially those with innovative features, might have untested vulnerabilities that could be exploited.

- Adoption and Scalability: Bitcoin’s widespread adoption as a digital gold and store of value contrasts with altcoins that are still gaining mainstream traction. Altcoins like Ethereum with scalable ecosystems face risks of adoption lag or technical bottlenecks.

Future Prospects

Bitcoin and altcoins show diverse future prospects, driven by evolving technological advancements and market trends.

- Technological Innovation: Bitcoin maintains its simplicity and security with incremental updates. Altcoins like Ethereum are at the forefront of blockchain innovation, pushing the boundaries with smart contracts and decentralized applications (dApps).

- Market Expansion: Bitcoin’s role as a store of value continues to grow, leading to increased institutional investment. Altcoins, providing various use cases such as DeFi (Decentralized Finance) and NFTs (Non-Fungible Tokens), attract a broad range of users looking beyond digital gold.

- Regulatory Clarity: Clearer regulations around Bitcoin contribute to its growing acceptance. Altcoins that achieve regulatory compliance could see significant adoption and investment influx, particularly those meeting global financial standards.

- Interoperability and Integration: Bitcoin’s integration into financial products and services increases its utility. Altcoins with interoperability features (e.g., Polkadot, Chainlink) potentially streamline the blockchain ecosystem, enabling seamless interactions between different chains.

- Community and Developer Support: Bitcoin benefits from a dedicated and large community that ensures continuous development and security updates. Altcoins with robust community and developer support are more likely to succeed, as they foster innovation and address potential issues swiftly.

By understanding these investment potentials and associated risks, investors can navigate the cryptocurrency market more effectively, balancing opportunities between Bitcoin and altcoins.

Is the innovative founder of The Digi Chain Exchange, a comprehensive platform dedicated to educating and empowering individuals in the world of digital finance. With a strong academic background in Finance and Computer Science from the University of Michigan, Scotterrin began her career in traditional finance before shifting her focus to blockchain technology and cryptocurrencies. An early adopter of Bitcoin and Ethereum, Adaha’s deep understanding of the transformative potential of blockchain led her to create The Digi Chain Exchange, which has since become a trusted resource for crypto news, market trends, and investment strategies.

Is the innovative founder of The Digi Chain Exchange, a comprehensive platform dedicated to educating and empowering individuals in the world of digital finance. With a strong academic background in Finance and Computer Science from the University of Michigan, Scotterrin began her career in traditional finance before shifting her focus to blockchain technology and cryptocurrencies. An early adopter of Bitcoin and Ethereum, Adaha’s deep understanding of the transformative potential of blockchain led her to create The Digi Chain Exchange, which has since become a trusted resource for crypto news, market trends, and investment strategies.