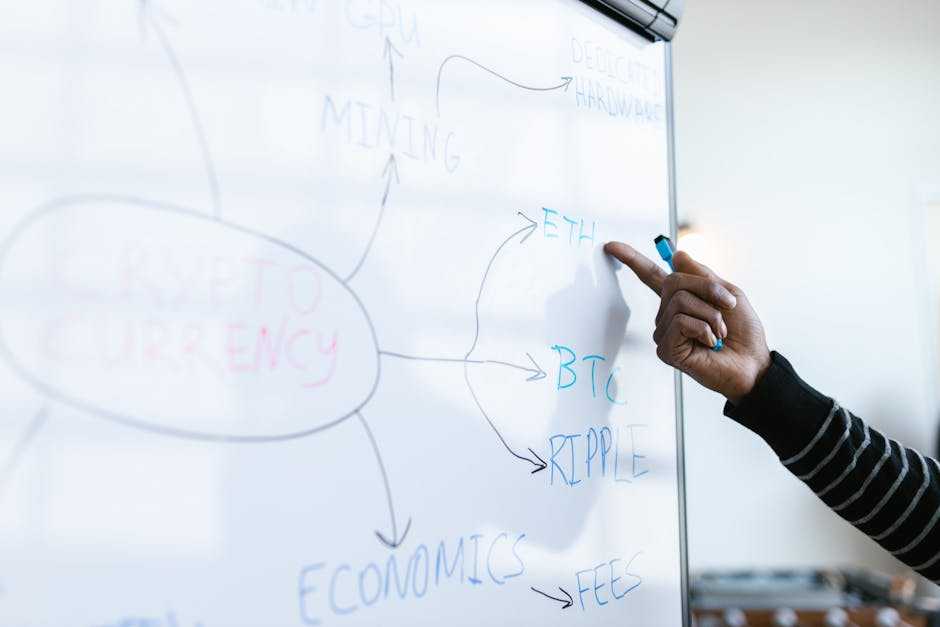

Understanding Cryptocurrency Market

To grasp the cryptocurrency market, understanding its foundational elements is crucial. Cryptocurrencies rely on blockchain technology, which ensures decentralized and tamper-proof transactions. Bitcoin, launched in 2009, serves as the pioneer and sets the tone for the market’s behavior.

Key Components of the Market

Various components define the cryptocurrency market:

- Supply and Demand: Like any market, the availability of coins versus user demand plays a significant role. For instance, Bitcoin’s capped supply at 21 million coins influences its price.

- Market Capitalization: This metric, reflecting the total value of a cryptocurrency, helps determine its market position. Higher market caps often indicate stability.

- Regulatory Environment: Regulatory frameworks can boost or hinder market growth. Announcements from bodies like the SEC often trigger immediate price reactions.

- Technology Advances: Innovations and tech improvements can increase a cryptocurrency’s value. Ethereum’s shift to proof-of-stake is one example.

Market Participants

Different participants impact market dynamics:

- Retail Investors: These individuals trade based on personal research and sentiment. Often, they react to news and trends.

- Institutional Investors: Their large-scale investments provide stability and can influence market directions.

- Miners: Responsible for validating transactions, miners receive new coins as rewards, affecting overall supply.

External Influences

Outside factors also dictate market behavior:

- Economic Indicators: Inflation rates and employment data can drive investment in cryptocurrencies as a hedge.

- Political Events: Instability or favorable policies can make cryptocurrencies more appealing.

- Global Events: Events like pandemics or natural disasters often drive people towards decentralized finance.

Understanding these elements provides a comprehensive view of how the cryptocurrency market operates and how it responds to various global events.

Key Global Events Affecting Prices

Various global events have profound impacts on cryptocurrency prices, often causing significant market fluctuations. These events range from geopolitical tensions to economic policies.

Geopolitical Tensions

Geopolitical tensions, such as conflicts and trade wars, often create uncertainty in financial markets. The uncertainty typically leads to increased volatility in cryptocurrency prices.

For example, during the US-China trade war in 2019, Bitcoin’s price saw a notable increase as investors sought safer assets. Similarly, political unrest in countries like Venezuela has driven local populations to turn to cryptocurrencies, affecting demand and thereby influencing prices.

Economic Policies

Economic policies, including interest rates and monetary policy adjustments, directly impact cryptocurrency prices. When central banks enact policies like quantitative easing, the resulting inflation fears can drive investors toward cryptocurrencies as a hedge.

For instance, during the COVID-19 pandemic, many governments’ stimulus packages and low-interest rates led to increased investment in Bitcoin and other cryptocurrencies as inflation hedges.

Technological Advancements

Technological advancements within the crypto ecosystem can trigger price changes. Innovations in blockchain technology, such as Ethereum’s transition to Proof of Stake, often attract increased investor interest and drive up prices.

Additionally, developments in security measures and scalability solutions can bolster investor confidence, leading to upward price movements.

For example, the Lightning Network’s implementation on Bitcoin’s blockchain improved transaction speed and scalability, contributing to price increases.

Regulatory Changes

Regulatory changes around the world significantly affect cryptocurrency prices. Announcements of new regulations, bans, or endorsements by major economies can cause immediate market reactions.

For instance, when China imposed stringent regulations on cryptocurrency exchanges in 2017, Bitcoin’s price plummeted. Conversely, when countries like El Salvador adopt Bitcoin as legal tender, the market responds positively. Regulatory clarity can provide stability, whereas uncertainty often leads to volatility.

Case Studies of Significant Events

Examining specific global events highlights how they dramatically impact cryptocurrency prices. I detail two pivotal cases the US presidential elections, and major security breaches.

US Presidential Elections

US presidential elections cause uncertainty that influences cryptocurrency prices. During the 2020 elections, Bitcoin’s price experienced volatility. It rose from around $10,500 in early October 2020 to nearly $19,000 by the end of November 2020, as investors speculated on regulatory changes.

The potential attitudes of leaders like Joe Biden towards cryptocurrency regulations added to the market’s nervousness. Historically, similar trends emerged during past elections, reflecting the market’s sensitivity to potential policy shifts.

Major Security Breaches

Security breaches in major cryptocurrency exchanges heavily impact market prices. When Mt. Gox was hacked in 2014, Bitcoin’s price plummeted from over $800 to around $450 within days.

This event cast a shadow of doubt over the security of digital assets. In another instance, the 2016 Bitfinex hack led to an approximate 20% drop in Bitcoin’s price.

Such breaches erode trust, leading to panic selling and temporary market downturns. Each incident highlights the vulnerability of the crypto ecosystem to security threats.

Long-Term vs Short-Term Impacts

Global events impact cryptocurrency prices differently over long and short terms. Short-term impacts often result from immediate reactions to news, such as geopolitical tensions or economic policies.

For example, a sudden announcement of a regulatory crackdown in one country usually triggers a quick price drop in Bitcoin or Ethereum. However, these effects might be temporary as the market adjusts.

Long-term impacts, in contrast, stem from sustained attention to larger trends. The ongoing debate over cryptocurrency regulation illustrates this.

While initial regulatory news causes short-term fluctuations, the long-term effects often stabilize as the industry and investors adapt to new norms. For instance, the implementation of clear regulations in multiple countries helps build investor confidence over time, leading to more stable and possibly higher prices.

Understanding these varying effects is crucial. Certain events like major technological advancements or widespread adoption of blockchain can create both immediate spikes and prolonged growth. Observing how different events impact the market over various timelines helps in better predicting future price movements.

Risk Management Strategies

Investors balance risks with thoughtful strategies during volatile cryptocurrency periods. Key strategies include:

- Diversification

Spread investments across various assets. Allocate funds to cryptocurrencies, stocks, and bonds. Reduce exposure to one asset class. An example is splitting investments between Bitcoin, Ethereum, and traditional stocks. - Stop-Loss Orders

Protect against drastic losses with stop-loss orders. Set a predefined price to automatically sell assets. If Ethereum drops below $1,800, a stop-loss order automatically sells it. - Hedging

Mitigate potential losses using hedging. Use derivatives like futures contracts. A decline in Bitcoin can be counterbalanced by holding a short BTC futures position. - Stablecoins

Maintain liquidity with stablecoins. Pegged to fiat currencies, stablecoins like USDT reduce volatility. During a market downturn, convert holdings to stablecoins to preserve value. - Regular Monitoring

Stay informed about market trends and global events. Use reliable sources for updates. Crypto news websites, financial journals, and social media provide valuable insights. Regulatory news in major economies can significantly impact prices. - Technical Analysis

Use technical analysis to guide decisions. Interpret charts and indicators to predict price movements. Patterns like moving averages and RSI (Relative Strength Index) help in timing the market. - Long-term Perspective

Focus on long-term growth. Avoid frequent trading based on short-term movements. Assess a cryptocurrency’s underlying technology and adoption potential, looking beyond short-lived spikes and declines. - Risk Tolerance Assessment

Assess personal risk tolerance. Tailor strategies to individual comfort levels. Higher tolerance might involve more aggressive buying during dips, while conservative approaches focus on preserving capital.

Integrating these strategies enhances resilience to the cryptocurrency market’s inherent volatility amid global events.

Alice Morillo is a prominent figure at The Digi Chain Exchange, known for her passion and expertise in the field of cryptocurrency and digital finance. With a keen interest in the evolving landscape of blockchain technology, Alice has dedicated herself to providing insightful content that helps both new and seasoned investors navigate the complexities of the crypto world. Her contributions to The Digi Chain Exchange reflect her deep understanding of market trends, trading strategies, and the regulatory environment surrounding digital assets.

Alice Morillo is a prominent figure at The Digi Chain Exchange, known for her passion and expertise in the field of cryptocurrency and digital finance. With a keen interest in the evolving landscape of blockchain technology, Alice has dedicated herself to providing insightful content that helps both new and seasoned investors navigate the complexities of the crypto world. Her contributions to The Digi Chain Exchange reflect her deep understanding of market trends, trading strategies, and the regulatory environment surrounding digital assets.