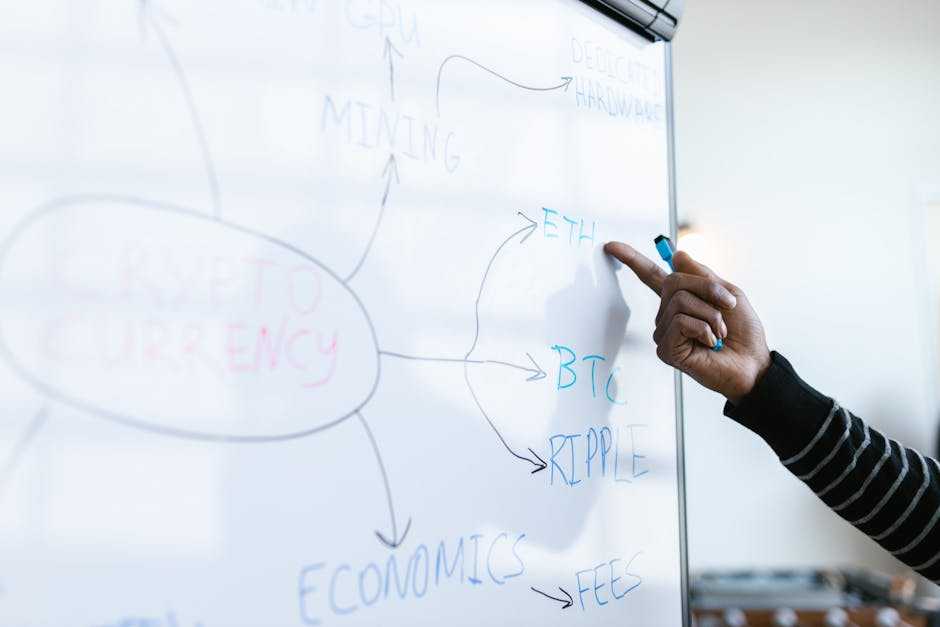

Overview Of The Crypto Market

The crypto market has seen significant growth in recent years, with Bitcoin and Ethereum leading the charge. These digital assets have attracted both individual investors and institutional players. In 2021, Bitcoin reached an all-time high of nearly $65,000, showcasing its potential for high returns. Ethereum, the second-largest cryptocurrency by market capitalization, also made headlines with its transition to Ethereum 2.0, aiming for more scalability and efficiency.

Cryptocurrency adoption is expanding beyond investments. Major companies like Tesla and Square have added Bitcoin to their balance sheets. Meanwhile, El Salvador became the first country to adopt Bitcoin as legal tender in September 2021. These developments indicate growing acceptance and integration of cryptocurrencies into mainstream financial systems.

Regulations are playing a crucial role in shaping the crypto market’s future. Governments worldwide are increasingly focusing on creating a regulatory framework to manage blockchain technology, Initial Coin Offerings (ICOs), and cryptocurrency exchanges. For instance, the U.S. Securities and Exchange Commission (SEC) has tightened its oversight on crypto trading and ICOs to protect investors and ensure market integrity.

Decentralized Finance (DeFi) is another emerging trend reshaping the financial landscape. DeFi platforms like Uniswap and Aave are disrupting traditional banking by offering services such as lending, borrowing, and trading without intermediaries. In 2021, the total value locked in DeFi protocols surpassed $100 billion, reflecting its growing impact.

NFTs (Non-Fungible Tokens) have created a buzz, particularly in digital art and collectibles. Artists and creators are leveraging blockchain to monetize digital content, with some NFT sales reaching millions of dollars. This new asset class is attracting more participants, further diversifying the crypto market.

Blockchain technology is not limited to cryptocurrencies. Industries like:

- supply chain management

- healthcare

- real estate

are exploring blockchain for its potential to improve transparency, security, and efficiency. For example, IBM and Maersk developed TradeLens, a blockchain-based platform to digitalize global trade logistics.

Market volatility remains a defining characteristic of cryptocurrencies. Price swings can be drastic due to factors like regulatory news, technological advancements, and market sentiment. Investors must stay informed about these dynamics to manage risks effectively.

The crypto market is multifaceted, driven by diverse factors ranging from technological innovation to regulatory developments and market adoption. Keeping abreast of these trends is essential for anyone looking to navigate this complex yet promising financial landscape.

Key Predictions For Major Cryptocurrencies

Expert insights provide valuable direction in the chaotic world of cryptocurrencies. The following are significant predictions for the leading players in the crypto market.

Bitcoin (BTC)

Bitcoin remains dominant in the market. Analysts predict its value could reach $100,000 within the next year.

Companies like MicroStrategy continue to invest heavily in Bitcoin, signaling long-term bullish trends. Major institutions’ entry into Bitcoin is likely to drive further adoption. Regulatory clarity, however, will influence its market dynamics.

Ethereum (ETH)

Ethereum’s future looks promising, with its price potentially rising to $10,000 by year-end. The Ethereum 2.0 upgrade aims to improve scalability and security, attracting more developers.

Experts believe DeFi projects utilizing Ethereum’s blockchain will fuel its growth. Contract execution and transaction speed enhancements are also anticipated impacts of the upgrade.

Ripple (XRP)

Ripple faces ongoing regulation-related challenges, but its market position remains strong. Predictions indicate XRP’s value could surge to $5 if the SEC lawsuit resolves favorably. Financial institutions using RippleNet for cross-border transactions highlight its utility. Analysts foresee a significant uptick in adoption rates upon regulatory resolution.

Emerging Trends And Technologies

Crypto market dynamics constantly evolve, with new trends and technologies shaping the financial landscape in real-time.

DeFi (Decentralized Finance)

DeFi represents a significant shift from traditional financial systems to decentralized, blockchain-based platforms. These platforms offer services such as lending, borrowing, and trading without intermediaries.

Adoption of DeFi has surged due to its transparency and potential for higher returns. Leading platforms like Uniswap, Aave, and Compound exemplify successful DeFi projects.

DeFi’s total value locked (TVL) reached over $100 billion in 2021, indicating strong market confidence. The continued improvement of token standards, security protocols, and user-friendly interfaces will drive further growth in DeFi.

NFTs (Non-Fungible Tokens)

NFTs have revolutionized the digital art and collectibles market, creating unique digital assets that are verifiable and transferable. Unlike cryptocurrencies, which are fungible, NFTs represent ownership of a specific item.

Major platforms like OpenSea and Rarible support a booming NFT marketplace. NFTs gained mainstream attention with high-profile sales such as Beeple’s artwork auctioned for $69 million.

Beyond art, NFTs find applications in gaming, virtual real estate, and intellectual property. As blockchain technology matures, the utility and acceptance of NFTs will likely expand, offering new opportunities for creators and investors alike.

Expert Opinions On Market Volatility

Experts regularly weigh in on crypto market volatility, providing crucial insights for investors. Prices often show sharp fluctuations, making it essential to stay informed.

Factors Influencing Volatility

Industry analysts highlight several factors affecting volatility. Bitcoin and Ethereum news headlines impact market sentiment. Positive news like corporate adoption leads to price spikes, whereas regulatory crackdowns cause downturns.

Market liquidity also plays a role—cryptocurrencies with lower liquidity experience higher volatility. Furthermore, macroeconomic factors and geopolitical events influence overall market conditions. El Salvador’s adoption of Bitcoin exemplifies how geopolitical decisions can affect prices.

Another aspect experts note is the speculative nature of the market. Retail investors driven by FOMO (Fear of Missing Out) often enter during price surges, exacerbating volatility. Additionally, technological developments or failures can unsettle the market. For instance, delays in Ethereum’s 2.0 upgrade generated uncertainty.

How To Manage Risks

- Risk management becomes paramount given the volatile nature of the crypto market.

- Experts advise diversification.

- By investing in multiple cryptocurrencies, I can mitigate the impact of a singular asset’s poor performance.

- Another strategy is setting stop-loss orders to automatically sell assets at a predefined price.

- Doing so limits potential losses during a market downturn.

- Maintaining a long-term perspective helps manage short-term fluctuations. By focusing on potential growth over several years, I can avoid panic-selling during brief market dips.

- Experts also recommend keeping abreast of regulatory updates and technological advancements.

- Staying informed empowers better decision-making.

- Investing only what I can afford to lose ensures financial stability. By not overextending investments, I can avoid severe financial repercussions during high volatility.

- Stablecoins, pegged to fiat currencies like the US dollar, provide a refuge during turbulent times, offering value stability in my portfolio.

Future Of Crypto Regulations

Predictions about the crypto market wouldn’t be complete without addressing potential regulatory shifts. Regulatory changes can significantly influence the crypto landscape, affecting everything from market sentiment to investors’ strategies.

Potential Regulatory Changes

Governments worldwide are exploring ways to regulate the crypto market more effectively. For example, the U.S. is considering classifying certain digital assets as securities, which would place them under the SEC’s jurisdiction.

Europe’s Markets in Crypto-Assets (MiCA) regulation aims to provide a comprehensive regulatory framework across EU member states, covering aspects like stablecoins and market manipulation. China’s stringent restrictions highlight a contrasting approach, banning all crypto transactions and mining activities.

Emerging regulations might also target DeFi platforms, requiring them to comply with existing financial regulations. Such rules could mandate more transparency and accountability, reducing risks for investors but potentially stifling innovation.

Impact On The Market

Regulatory changes can create both opportunities and challenges for the crypto market. For instance, clear regulations might attract institutional investors, who seek a more stable investment environment.

Conversely, stringent rules could drive some crypto activities underground or push them into less regulated jurisdictions.

Market reactions often depend on the specifics and scope of the regulations introduced. For example, Bitcoin and Ethereum saw price slumps following negative regulatory news from China.

On the other hand, regulatory clarity in countries like Switzerland and Japan has fostered a more mature and resilient market.

Investors might adapt by diversifying their portfolios to include assets more likely to remain compliant under new regulations. Some might also gravitate towards decentralized exchanges (DEXs) and other platforms less likely to be affected by stringent rules.

The key lies in staying informed about regulatory developments and understanding their potential impact on various crypto assets.

Is the innovative founder of The Digi Chain Exchange, a comprehensive platform dedicated to educating and empowering individuals in the world of digital finance. With a strong academic background in Finance and Computer Science from the University of Michigan, Scotterrin began her career in traditional finance before shifting her focus to blockchain technology and cryptocurrencies. An early adopter of Bitcoin and Ethereum, Adaha’s deep understanding of the transformative potential of blockchain led her to create The Digi Chain Exchange, which has since become a trusted resource for crypto news, market trends, and investment strategies.

Is the innovative founder of The Digi Chain Exchange, a comprehensive platform dedicated to educating and empowering individuals in the world of digital finance. With a strong academic background in Finance and Computer Science from the University of Michigan, Scotterrin began her career in traditional finance before shifting her focus to blockchain technology and cryptocurrencies. An early adopter of Bitcoin and Ethereum, Adaha’s deep understanding of the transformative potential of blockchain led her to create The Digi Chain Exchange, which has since become a trusted resource for crypto news, market trends, and investment strategies.