Understanding NFTs

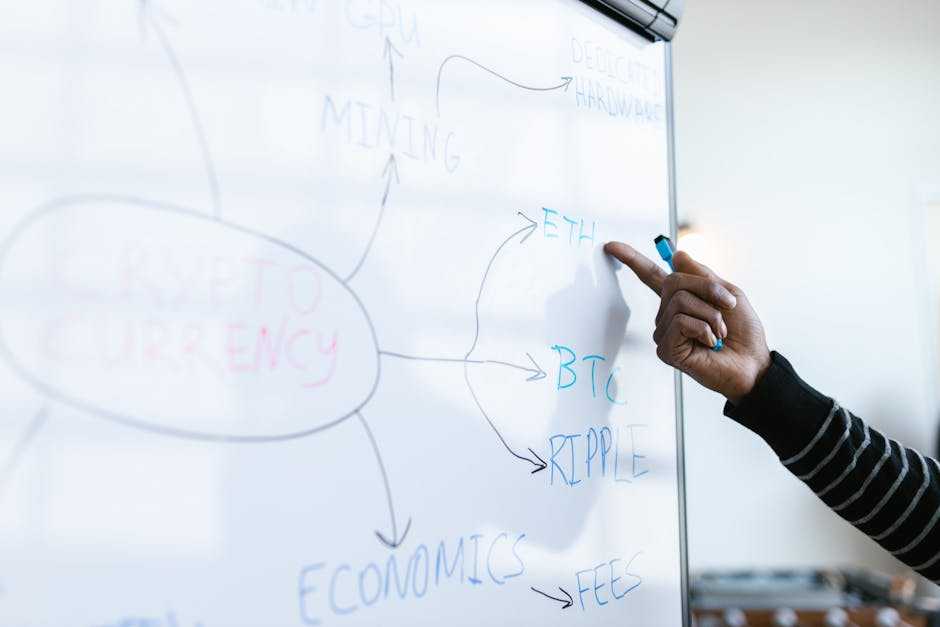

NFTs, or non-fungible tokens, represent unique digital assets verified using blockchain technology. Unlike cryptocurrencies like Bitcoin, NFTs cannot be exchanged on a one-to-one basis since each token holds distinct value and attributes. This uniqueness allows them to certify ownership of digital items like:

- art

- music

- videos

- virtual real estate

An NFT has metadata that includes details about its creation, ownership, and transaction history. This metadata creates transparency and authenticity, empowering creators by giving them control over their intellectual property and enabling new revenue streams through royalties and resales.

Blockchain platforms like Ethereum facilitate the creation and trading of NFTs. These platforms support smart contracts that define the terms of ownership and transfer. Some popular marketplaces for NFTs include OpenSea, Rarible, and Foundation. Each marketplace caters to different types of digital assets, ranging from art to collectibles and beyond.

High-profile sales have brought considerable attention to NFTs. For instance, digital artist Beeple’s “Everydays: The First 5000 Days” sold for $69.3 million in March 2021, highlighting the potential value of digital art. Similarly, notable sports moments captured as NFTs allow fans to own a piece of history.

However, NFTs face criticisms related to environmental impact due to the energy-intensive nature of blockchain transactions. Efforts are underway to mitigate these issues through more sustainable blockchain practices and platforms.

NFT Trends in Art

NFTs significantly impact the art world, revolutionizing digital ownership and creativity.

Digital Art and Collectibles

Artists now mint unique artworks as NFTs. Platforms like OpenSea and Rarible facilitate buying, selling, and trading digital art pieces. NFT collectibles, such as CryptoPunks, have gained popularity, with some fetching millions. The decentralized nature ensures provenance and scarcity, protecting artists’ rights and income streams.

Evolution of Art Marketplaces

Art marketplaces evolved to include NFT-specific platforms. SuperRare and Foundation enable artists to list and monetize their digital creations.

These marketplaces use smart contracts to automate royalty payments, ensuring artists receive a fair share from secondary sales. Traditional auction houses, like Christie’s, have embraced NFTs, bridging the gap between conventional and digital art markets. This evolution democratizes access to art, allowing global participation in art trading.

NFT Trends in Gaming

NFTs are transforming the gaming world by bringing unique digital assets and new economic models to the forefront.

Play-to-Earn Models

Play-to-earn models allow players to earn NFTs as rewards for in-game achievements. Popular games like Axie Infinity and The Sandbox use blockchain technology to provide players with ownership of in-game assets.

Players can sell, trade, or rent these assets in secondary marketplaces, generating real income while playing. This model also incentivizes long-term engagement and fosters vibrant player communities. Axie Infinity players earn tokens called Smooth Love Potions (SLP) by battling in the game, which they can sell on various crypto exchanges.

Virtual Assets and Gaming Economies

Virtual assets in gaming create digital scarcity and ownership, allowing players to own unique items. These assets can range from skins and weapons to virtual real estate and characters.

Games like Decentraland and Cryptovoxels enable players to buy, sell, and develop virtual land using NFTs. These gaming economies leverage blockchain technology to ensure transparency and security, allowing secure transactions of virtual goods.

For example, in Decentraland, users purchase virtual plots of land using the MANA token, creating a decentralized, user-owned world. These thriving virtual economies offer new ways for gamers to monetize their time and creativity, disrupting traditional gaming models.

Beyond Art and Gaming

NFTs continue to evolve, permeating various sectors beyond art and gaming. These digital assets integrate into industries like music, entertainment, and real estate, offering unique applications and driving innovation.

NFTs in Music and Entertainment

Musicians and entertainers harness NFTs to engage with their audiences in novel ways. Artists mint exclusive tracks or albums as NFTs, providing fans with distinct ownership and access. Notable examples include Kings of Leon, who released an album as an NFT, and DJ 3LAU, who auctioned off an entire album on the blockchain.

Concert organizers use NFTs to issue virtual tickets, ensuring authenticity and reducing scalping. For instance, the virtual festival “Decentraland Music Festival” used blockchain technology to manage event access. NFTs in entertainment extend to movies and TV shows, with platforms like Vuele enabling viewers to own digital copies and collectibles from their favorite films.

NFTs in Real Estate and Virtual Land

The real estate sector leverages NFTs to revolutionize property transactions. NFTs represent physical real estate, allowing fractional ownership and simplifying processes. Propy, a blockchain-based real estate platform, facilitates properties’ sale and purchase using NFTs, making the process transparent and secure.

Virtual land markets in the metaverse use NFTs to sell parcels of digital land. Platforms like Decentraland and CryptoVoxels allow users to buy, sell, and develop virtual real estate. These parcels serve as venues for various activities, including virtual concerts, galleries, and social gatherings, creating a thriving virtual economy.

Harboring immense potential, NFTs continue to transform various industries, offering innovative solutions and enhancing user engagement across music, entertainment, and real estate sectors.

Potential Challenges and Concerns

Despite the benefits of NFTs, several challenges and concerns arise that need addressing to ensure their sustainable growth.

Environmental Impact

NFTs require significant energy consumption due to the underlying blockchain technology, particularly Proof of Work (PoW) models used by Ethereum. For instance, a single NFT transaction can consume as much energy as an average household uses in several days.

This energy usage raises concerns about carbon footprint and environmental sustainability. While some blockchains, like Ethereum, plan to transition to more eco-friendly alternatives like Proof of Stake (PoS), widespread adoption is necessary to mitigate these environmental concerns.

Legal and Regulatory Issues

Legal and regulatory challenges surround NFTs, especially in defining intellectual property rights and authenticity. Ownership of an NFT doesn’t always confer rights to the underlying asset, leading to potential disputes over content usage.

Fraud and market manipulation are other significant concerns, with cases of counterfeit NFTs and artificial price inflation emerging. Regulatory bodies are still developing frameworks to address these issues, leaving a legal gray area that could impact the credibility and stability of the NFT market.

The Future of NFTs

NFTs continue evolving, permeating various industries and transforming digital ownership. Innovations and market predictions highlight their multifaceted potential.

Technological Innovations

Rapid advancements shape the NFT landscape. Layer 2 solutions, such as Polygon, enhance scalability by handling transactions off the main Ethereum chain. This reduces fees and energy consumption. Interoperability standards like ERC-721 and ERC-1155 foster seamless integration across different platforms.

Artificial Intelligence (AI) introduces dynamic NFTs. These tokens adapt their features over time, using predefined conditions or real-world data. Examples include evolutionary art pieces and game characters improving with usage.

Enhanced security measures address fraud and authenticity issues. Zero-Knowledge Proofs (ZKPs) and decentralized identity protocols ensure verification without compromising privacy.

Market Predictions

- Experts foresee NFTs gaining mainstream adoption. By 2025, the NFT market could exceed $30 billion, driven by digital art, gaming, and virtual real estate. Traditional sectors like fashion and sports are also entering the NFT space, offering unique experiences through tokenized assets.

- Major brands utilize NFTs for marketing and customer engagement. For instance, Nike’s Cryptokicks integrates physical and digital sneaker ownership, while sports leagues issue collectible highlights as NFTs.

- Decentralized Finance (DeFi) intersects with NFTs, creating new financial products. NFT lending platforms allow users to leverage their digital assets as collateral for loans, expanding the utility of NFTs beyond simple ownership.

- Emerging ecosystems support creators and users. Community-driven projects and DAOs (Decentralized Autonomous Organizations) empower participants to shape the future of NFTs collaboratively. NFTs are not only here to stay but are also poised to redefine multiple sectors as technology and market acceptance advance.

Ricky Morenolendez is a key contributor at The Digi Chain Exchange, recognized for his deep expertise in cryptocurrency and blockchain technology. With years of experience in analyzing market trends and providing actionable insights, Ricky has become a trusted voice in the crypto space. His work focuses on helping investors understand the nuances of digital assets, from Bitcoin to emerging altcoins. Ricky’s dedication to educating the community on market strategies and crypto developments has made him an invaluable asset to The Digi Chain Exchange team.

Ricky Morenolendez is a key contributor at The Digi Chain Exchange, recognized for his deep expertise in cryptocurrency and blockchain technology. With years of experience in analyzing market trends and providing actionable insights, Ricky has become a trusted voice in the crypto space. His work focuses on helping investors understand the nuances of digital assets, from Bitcoin to emerging altcoins. Ricky’s dedication to educating the community on market strategies and crypto developments has made him an invaluable asset to The Digi Chain Exchange team.