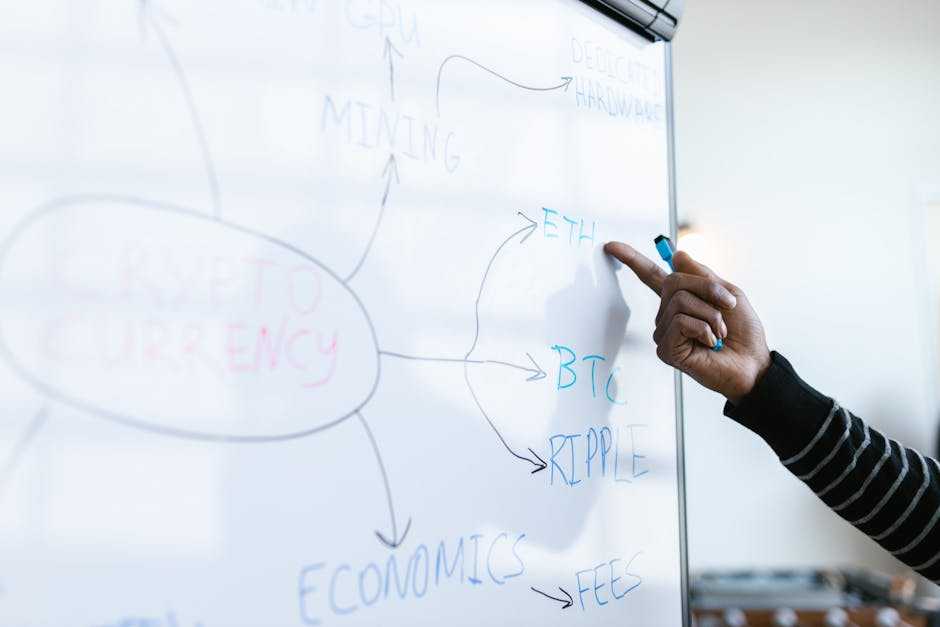

Understanding Blockchain Technology

Blockchain technology, a decentralized ledger system, records transactions across a network of computers. Each block contains transaction data, a timestamp, and a cryptographic hash of the previous block, forming a secure and transparent chain. This architecture ensures data integrity, as altering data in one block requires changes to all subsequent blocks, making tampering nearly impossible.

Originally designed for cryptocurrency transactions, blockchain’s framework now finds applications in various sectors. For instance, it facilitates secure and transparent voting systems, supply chain tracking, and digital identity verification. Blockchain’s potential to eliminate intermediaries streamlines processes and reduces costs across multiple industries.

Smart contracts, self-executing contracts with the terms directly written into code, exemplify blockchain’s versatile applications. These contracts automatically enforce and execute agreements when predefined conditions are met. This innovation reduces the need for manual oversight and minimizes potential disputes, benefiting sectors like real estate and finance that rely on contractual agreements.

Blockchain’s decentralized nature poses both opportunities and challenges. While it enhances security and transparency, it also raises concerns regarding scalability, energy consumption, and regulatory compliance. Addressing these issues is crucial for the widespread adoption of blockchain solutions, as they influence both market acceptance and technological progress.

By understanding these fundamental aspects, stakeholders can better appreciate blockchain’s transformative potential. Blockchain technology’s evolving landscape continues to present opportunities for innovation, driving industry-wide changes.

Recent Advancements in Blockchain

Recent advancements in blockchain technology have revolutionized various industries and prompted innovations that promise to reshape markets. Below are some of the most impactful developments.

Smart Contracts

Smart contracts automate and execute agreements once predefined conditions are met, reducing the need for intermediaries. This innovation has streamlined processes in real estate, finance, and supply chain management.

Real estate transactions now finalize without traditional escrow services, saving time and costs. In finance, automated contracts handle loan disbursements and repayments efficiently. Supply chains benefit from real-time updates and more efficient logistics, minimizing delays and errors.

Interoperability

Interoperability enables different blockchain networks to communicate and share information seamlessly. This breakthrough addresses the fragmentation issue prevalent in blockchain ecosystems.

Compatibility between networks like Ethereum, Polkadot, and Binance Smart Chain has facilitated more robust and flexible solutions. For example, users can transfer assets and data across platforms without needing a centralized exchange, enhancing user experience and application capabilities.

Decentralized Finance (DeFi)

Decentralized Finance (DeFi) has democratized access to financial services by eliminating traditional banking intermediaries. DeFi platforms offer lending, borrowing, and trading services directly on blockchain networks.

Users can earn interest on digital assets through staking and liquidity pools. Decentralized exchanges (DEXs) have grown in popularity, enabling peer-to-peer trading without the need for a broker and lowering transaction fees.

Non-Fungible Tokens (NFTs)

Non-Fungible Tokens (NFTs) have transformed how digital ownership and provenance are verified. NFTs represent unique digital assets, ranging from art and music to virtual real estate.

The art industry has particularly benefited, with artists monetizing digital creations directly through blockchain marketplaces like OpenSea. NFTs also enable new revenue streams in gaming, where players trade virtual items in decentralized marketplaces, enhancing the gaming experience and ecosystem.

Market Implications of Blockchain Trends

The rapid evolution of blockchain technology is driving significant shifts in various markets. Understanding these changes is pivotal for stakeholders aiming to harness blockchain’s full potential.

Impact on Financial Services

Blockchain has revolutionized financial services with the advent of Decentralized Finance (DeFi). DeFi platforms eliminate intermediaries, reducing transaction costs and increasing accessibility. Smart contracts automate processes, enhancing efficiency and reducing risks. According to DeFi Pulse, the total value locked in DeFi surpassed $90 billion in 2021, illustrating significant market adoption.

Changes in Supply Chain Management

In supply chain management, blockchain ensures transparency and traceability. Companies employ blockchain to track goods from origin to consumer, reducing fraud and improving efficiency.

Walmart uses blockchain to track the food supply chain, enhancing safety and reducing trace-back times from weeks to seconds. This level of transparency fosters consumer trust and optimizes logistics.

Innovations in Digital Identity and Security

Blockchain technology has introduced innovations in digital identity verification and security. Decentralized Identifiers (DIDs) let individuals control their identity data, reducing identity theft risks.

Microsoft’s Azure Active Directory Verifiable Claims leverages blockchain to offer secure, verifiable identities. These advancements significantly impact markets by enhancing user privacy and security.

Challenges and Risks

Blockchain technology faces several challenges and risks that could impact its widespread adoption and implementation.

Scalability Issues

Scalability remains a primary challenge for blockchain networks. Most networks struggle to process a high number of transactions per second compared to traditional systems like Visa, which handles 24,000 transactions per second.

For instance, Bitcoin processes around 7 transactions per second, and Ethereum processes about 30 transactions per second. Enhancing scalability without compromising security or decentralization requires innovative solutions, such as sharding and layer-2 protocols.

Regulatory Uncertainty

Regulatory uncertainty affects blockchain’s growth. Different jurisdictions impose varying regulations, leading to inconsistencies. In the U.S., the Securities and Exchange Commission (SEC) has classified some cryptocurrencies as securities, while others remain unclassified.

The European Union’s Markets in Crypto-Assets (MiCA) regulations aim to provide clarity, yet global harmonization is lacking. Businesses must navigate these regulatory landscapes carefully to avoid legal pitfalls and ensure compliance.

Security Concerns

Security concerns pose significant risks to blockchain adoption. While blockchain’s design provides inherent security advantages, vulnerabilities still exist.

For example, the 51% attack threat, where bad actors control the majority of a network’s mining power, could potentially alter blockchain records.

Notable instances include the attacks on Bitcoin Gold and Ethereum Classic. Smart contract vulnerabilities, like the DAO hack in 2016, also highlight potential risks. Ensuring robust security measures and constant network monitoring is essential to mitigate these threats.

Future Outlook for Blockchain Technology

Blockchain technology offers extensive potential across industries. Global spending on blockchain solutions reached $6.6 billion in 2021 (source: IDC). By 2025, market forecasts predict this spending will expand to $19 billion, indicating strong market adoption.

Enhanced Interoperability

Greater interoperability between different blockchain networks stands as a significant advancement. Interoperability involves seamless data and asset transfers across various blockchain systems. Projects like Polkadot and Cosmos are already making strides, enabling blockchains to communicate without intermediaries.

Smart Contract Evolution

Smart contracts in blockchain technology automate processes, reducing the need for manual intervention. Future advancements include enhanced security features and increased scalability. Ethereum 2.0, a major upgrade, aims to address scalability and energy efficiency issues, boosting smart contract execution.

Increased Enterprise Adoption

Enterprises are progressively adopting blockchain for security and transparency in supply chains. Walmart and IBM, for instance, use blockchain to trace produce from farm to shelf.

Such implementation reduces fraud and improves efficiency. Predictions show more sectors, including:

- finance

- healthcare

- real estate

will follow.

Regulatory Developments

Governments are increasingly recognizing the significance of blockchain. Regulatory frameworks are likely to become more defined, providing clearer guidelines for businesses.

Notable is the European Union’s Markets in Crypto-Assets (MiCA) regulation that will offer regulatory certainty. Compliance with these regulations will reduce risks and promote market stability.

Sustainable Blockchain Practices

Blockchain’s environmental impact is a concern due to energy-consuming operations like mining. Efforts to create eco-friendly solutions are gaining traction.

Proof-of-stake (PoS) mechanisms, as seen with Ethereum’s transition from proof-of-work (PoW), reduce energy consumption significantly. Green blockchain initiatives will likely become standard, addressing environmental concerns.

Enhanced Security Measures

As blockchain technology advances, so do security measures. Innovations include zero-knowledge proofs, which allow data validation without sharing actual data.

Multi-signature wallets add another layer of security. Continuous improvements in security are essential to safeguard blockchain systems from evolving threats.

Integration with Emerging Technologies

Blockchain’s synergy with emerging technologies like AI and IoT creates immense potential. Blockchain can provide secure data exchange for IoT devices, reducing vulnerability to hacking.

AI algorithms can enhance blockchain efficiency and decision-making. This integration will unlock new capabilities and business models.

Decentralized Finance (DeFi) Expansion

- DeFi, another application of blockchain, offers financial instruments minus intermediaries.

- DeFi projects like Uniswap and Aave are revolutionizing lending and trading.

- The DeFi market is expected to grow, providing new financial services and democratizing access to financial systems.

- Blockchain’s future outlook remains promising, with continuous innovations, greater adoption across sectors, and evolving regulations ensuring its trajectory.

- The integration with other emerging technologies and the focus on sustainability will shape the landscape, making blockchain a cornerstone of future technological advancements.

Is the innovative founder of The Digi Chain Exchange, a comprehensive platform dedicated to educating and empowering individuals in the world of digital finance. With a strong academic background in Finance and Computer Science from the University of Michigan, Scotterrin began her career in traditional finance before shifting her focus to blockchain technology and cryptocurrencies. An early adopter of Bitcoin and Ethereum, Adaha’s deep understanding of the transformative potential of blockchain led her to create The Digi Chain Exchange, which has since become a trusted resource for crypto news, market trends, and investment strategies.

Is the innovative founder of The Digi Chain Exchange, a comprehensive platform dedicated to educating and empowering individuals in the world of digital finance. With a strong academic background in Finance and Computer Science from the University of Michigan, Scotterrin began her career in traditional finance before shifting her focus to blockchain technology and cryptocurrencies. An early adopter of Bitcoin and Ethereum, Adaha’s deep understanding of the transformative potential of blockchain led her to create The Digi Chain Exchange, which has since become a trusted resource for crypto news, market trends, and investment strategies.