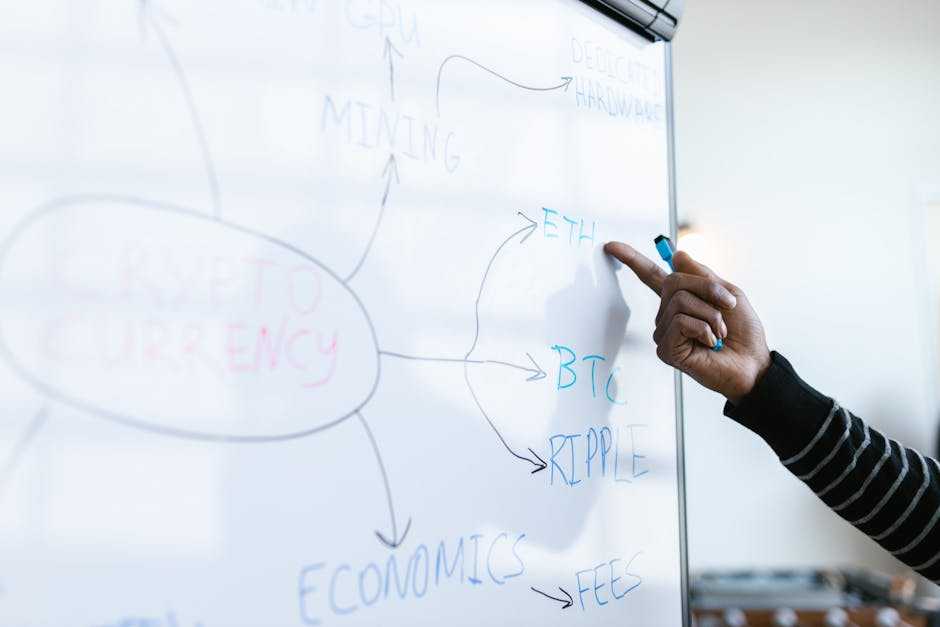

Understanding DeFi Tokens

Decentralized Finance (DeFi) tokens represent the assets in a rapidly evolving crypto sector. These tokens drive DeFi platforms and services.

What Are DeFi Tokens?

DeFi tokens power decentralized applications (dApps) in the blockchain ecosystem. Unlike traditional tokens, DeFi tokens enable various financial services without the need for intermediaries, such as banks. Examples include lending protocols, decentralized exchanges, and staking platforms.

- Decentralization: DeFi tokens operate on decentralized networks, primarily Ethereum, eliminating central authority control.

- Interoperability: DeFi tokens integrate seamlessly with multiple dApps and protocols, offering diverse use cases. For instance, Uniswap (UNI) facilitates decentralized trading.

- Governance: Many DeFi tokens grant holders voting rights to influence platform development and policies. Holders of Compound (COMP) can vote on protocol changes.

- Liquidity Provision: Users provide liquidity to DeFi pools, earning rewards. Tokens like Aave (AAVE) incentivize liquidity providers.

- Staking: Token holders can stake their assets to validate transactions or secure the network. Examples include staking on platforms like Polkadot (DOT).

By understanding DeFi tokens’ mechanics, we can grasp their significant role in reshaping the traditional financial landscape.

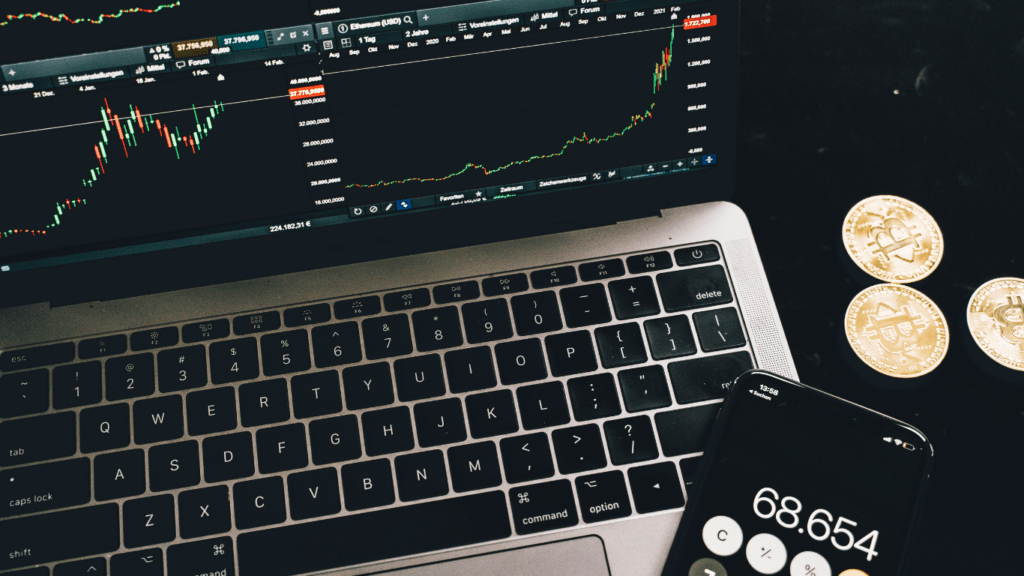

The Growth of DeFi Tokens

DeFi tokens have witnessed significant growth, transforming the financial landscape in the crypto market.

Historical Context

DeFi tokens emerged in 2017 with the launch of Ethereum-based protocols. Projects like MakerDAO and Compound initiated decentralized lending and borrowing, pioneering new financial models.

By 2020, the DeFi sector exploded, driven by innovations like yield farming and governance tokens, creating a $20 billion market by the end of the year. The introduction of liquidity pools, facilitated by platforms like Uniswap, further accelerated this growth. These developments marked DeFi as a key disruptor in traditional finance.

Factors Driving Growth

Several factors contributed to the surge in DeFi tokens.

- Decentralization: DeFi offers financial services without central authorities, ensuring greater transparency and security.

- Yield Farming: Investors earn rewards by providing liquidity, attracting significant capital inflows.

- Interoperability: DeFi tokens operate on various blockchains, enhancing accessibility and integration.

- Innovation: Continuous advancements in smart contracts and blockchain technology drive the sector forward.

- User Participation: Governance tokens empower users to influence project decisions, fostering a community-driven ecosystem.

DeFi’s promise of an open, transparent, and inclusive financial system propels its ongoing expansion, situating DeFi tokens as critical assets in the evolving crypto economy.

Major Players in the DeFi Space

Key players in the DeFi ecosystem drive innovation and adoption. Let’s explore leading projects and notable tokens shaping the crypto landscape.

Leading DeFi Projects

- MakerDAO: MakerDAO pioneered decentralized stablecoins with DAI. By using smart contracts on Ethereum, it enables users to lock assets as collateral and mint stablecoins pegged to USD. MakerDAO’s governance token MKR allows its holders to vote on protocol changes, ensuring decentralized governance.

- Aave: Aave redefined lending with its unique features like flash loans, enabling instant borrowing without collateral. Aave supports various assets, offering flexibility and encouraging liquidity. Governance is community-driven via the AAVE token.

- Uniswap: Uniswap revolutionized decentralized exchanges with its automated market maker (AMM) model. It facilitates token swaps without an order book, providing liquidity through user-contributed pools. Governance happens through the UNI token, giving holders a voice in protocol development.

- Compound: Compound allows users to supply or borrow assets seamlessly. Interest rates adjust algorithmically based on supply and demand. The COMP token governs the platform, empowering users to propose and vote on changes.

- Synthetix: Synthetix offers synthetic assets, representing real-world assets like fiat currencies and commodities, on the blockchain. Users can create and trade these assets, providing exposure without owning the underlying asset. The SNX token governs protocol mechanisms.

- DAI: DAI, a stablecoin from MakerDAO, maintains a 1:1 peg to USD through over-collateralized assets. It’s pivotal for transactions and lending in DeFi, offering stability amid crypto volatility.

- AAVE: The AAVE token empowers governance in the Aave protocol. Token holders propose and vote on protocol changes, ensuring community-driven evolution. Staking AAVE provides security and liquidity incentives.

- UNI: UNI, Uniswap’s governance token, allows holders to influence the platform’s future. Users gain voting rights on proposals, fee structures, and new features, fostering decentralized decision-making.

- COMP: Holding COMP grants governance power in the Compound protocol. Token holders vote on decisions about interest rates, asset inclusions, and protocol upgrades, driving platform improvements.

- SNX: Synthetix’s SNX token is essential for creating synthetic assets. Users stake SNX to back the creation of Synths (synthetic assets), ensuring collateralization and stability in the ecosystem.

Major players like MakerDAO, Aave, Uniswap, Compound, and Synthetix, alongside tokens such as DAI, AAVE, UNI, COMP, and SNX, define the DeFi landscape. They facilitate decentralized financial activities, drive innovation, and offer governance participation.

Risks and Challenges

DeFi tokens, while innovative, come with their own set of risks and challenges. It’s critical to identify these risks to make informed decisions.

Regulatory Concerns

Governments worldwide are scrutinizing DeFi projects for compliance. Regulatory frameworks vary across regions, creating legal ambiguities. If authorities tighten regulations, project operations could face disruptions.

For instance, the U.S. Securities and Exchange Commission (SEC) investigates whether certain DeFi tokens classify as securities, potentially requiring projects to register under stricter laws. DeFi projects must navigate regulatory landscapes to mitigate risks and maintain growth.

Security Issues

DeFi platforms face significant security threats. Smart contract vulnerabilities can lead to substantial losses. Hacking incidents like the $600 million Poly Network breach highlight this risk.

Audit failures and coding bugs expose platforms to exploits, making insurance and regular security audits critical. Users must be cautious when interacting with non-audited projects to avoid financial losses. Enhanced security protocols and community vigilance can help mitigate these issues, ensuring platform integrity.

Future Outlook of DeFi Tokens

The future of DeFi tokens shows significant promise driven by continuous innovation and increasing adoption. Several factors, including technological advancements and market dynamics, will influence these trajectories.

Predicted Trends

Emerging trends in DeFi tokens are shaping the future landscape. Integration with traditional finance, increased cross-chain compatibility, and advancements in decentralized governance are key areas of focus.

- Integration with Traditional Finance: DeFi projects are bridging gaps with traditional financial systems, creating hybrid products offering enhanced services.

- Cross-Chain Compatibility: Solutions enabling tokens to interact across different blockchain networks will enhance liquidity and create more fluid trading environments.

- Decentralized Governance: Improvements in governance models will enable token holders to have more significant impacts on project decisions and developments.

Potential Impact

DeFi tokens’ potential impact extends beyond the crypto market into the broader financial ecosystem. Increased accessibility, economic inclusion, and innovative financial products are some potential outcomes.

- Increased Accessibility: DeFi tokens provide global access to financial services without traditional banking constraints, promoting financial inclusion.

- Economic Inclusion: By lowering barriers to entry, DeFi tokens empower underserved populations to participate in the financial economy.

- Innovative Financial Products: New financial instruments based on DeFi tokens offer unique opportunities like yield farming and staking, attracting diverse investors.

The advancements in DeFi tokens will enhance the crypto market’s functionality while democratizing access to financial tools and resources on a global scale.

Is the innovative founder of The Digi Chain Exchange, a comprehensive platform dedicated to educating and empowering individuals in the world of digital finance. With a strong academic background in Finance and Computer Science from the University of Michigan, Scotterrin began her career in traditional finance before shifting her focus to blockchain technology and cryptocurrencies. An early adopter of Bitcoin and Ethereum, Adaha’s deep understanding of the transformative potential of blockchain led her to create The Digi Chain Exchange, which has since become a trusted resource for crypto news, market trends, and investment strategies.

Is the innovative founder of The Digi Chain Exchange, a comprehensive platform dedicated to educating and empowering individuals in the world of digital finance. With a strong academic background in Finance and Computer Science from the University of Michigan, Scotterrin began her career in traditional finance before shifting her focus to blockchain technology and cryptocurrencies. An early adopter of Bitcoin and Ethereum, Adaha’s deep understanding of the transformative potential of blockchain led her to create The Digi Chain Exchange, which has since become a trusted resource for crypto news, market trends, and investment strategies.