Understanding Technical Analysis

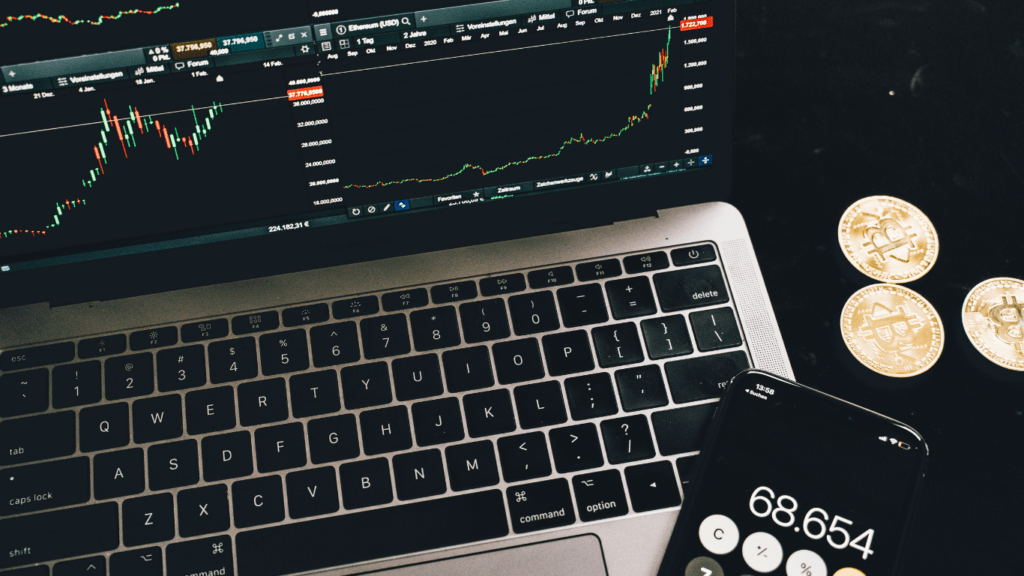

Technical analysis relies on historical data, mainly price and volume, to predict future price movements. It focuses on identifying patterns in trading behaviors. I use charts and indicators to uncover these patterns and make informed decisions.

Charts are essential tools in technical analysis. They visually represent price movements over time. Common chart types include line, bar, and candlestick.

- Line Charts: Simplest form, showing closing prices over a period.

- Bar Charts: Display opening, closing, high, and low prices for each period.

- Candlestick Charts: Similar to bar charts but more visually detailed, showing price direction with color-coded bars.

Indicators offer additional insights. I often use moving averages and Relative Strength Index (RSI).

- Moving Averages: Track average prices over periods, smoothing out price data to identify trends.

- Relative Strength Index (RSI): Measures the speed and change of price movements to determine overbought or oversold conditions.

Volume analysis helps validate trends. I check trading volumes alongside price movements to confirm the strength of trends.

- High Volume: Indicates stronger trends and potential reversals.

- Low Volume: Suggests weaker trends and possible false signals.

By combining these tools, I gain a clearer picture of market conditions. Recognizing patterns like head and shoulders or double tops and bottoms also aids prediction accuracy.

Incorporating all these aspects into my trading strategy improves my decision-making process. Technical analysis thus becomes indispensable for navigating crypto market volatility and maximizing success.

Key Indicators in Crypto Trading

Technical analysis relies on specific indicators to interpret market patterns effectively. Several key indicators enhance the accuracy of predictions and trading strategies.

Moving Averages

Moving averages smooth out price data, creating a single flowing line to identify trends. The two main types are Simple Moving Averages (SMA) and Exponential Moving Averages (EMA). The SMA calculates the average price over a specific period, while the EMA gives more weight to recent prices. For example, a 50-day SMA provides a longer-term view, whereas a 20-day EMA reacts faster to price changes.

Relative Strength Index (RSI)

The RSI measures the speed and change of price movements, oscillating between 0 and 100. It identifies overbought or oversold conditions when it crosses specific thresholds. A value above 70 suggests an overbought market, potentially indicating a price correction, while a value below 30 indicates an oversold market, suggesting a potential price increase. Traders use the RSI to gauge market momentum.

Bollinger Bands

Bollinger Bands consist of three lines: the middle band (SMA), upper band, and lower band. These bands adjust based on market volatility. The price tends to stay within the bands, expanding during high volatility and contracting during low volatility. When prices touch the upper band, it indicates overbought conditions; touching the lower band signals oversold conditions. This helps determine entry and exit points.

MACD

The Moving Average Convergence Divergence (MACD) highlights changes in the strength, direction, momentum, and duration of a trend. It consists of the MACD line, signal line, and histogram.

The MACD line results from subtracting the 26-period EMA from the 12-period EMA. The signal line is the 9-period EMA of the MACD line. An upward crossover indicates bullish momentum; a downward crossover points to bearish momentum. Traders use the MACD to spot potential buy or sell signals.

Chart Patterns to Watch

Understanding chart patterns helps predict crypto price movements by identifying potential trends and reversals. Here are some key patterns to watch.

Head and Shoulders

The Head and Shoulders pattern signals trend reversals. It’s composed of three peaks: two smaller ones (shoulders) encasing a larger one (head). An upward trend reverses downwards upon completing this pattern. Conversely, the inverse pattern predicts a shift from bearish to bullish. Spotting these patterns helps in entering or exiting trades at optimal points.

Double Tops and Bottoms

Double Tops and Bottoms indicate potential trend reversals. The Double Top forms after a significant upward trend, with the price peaking twice at similar levels before falling. It signifies a possible bearish reversal. The Double Bottom mirrors this in a downtrend, with two similar troughs leading to a bullish reversal. These patterns provide critical buy or sell signals in volatile markets.

Triangles and Flags

Triangles and Flags are continuation patterns used to predict trend directions. Triangles can be ascending, descending, or symmetrical. An ascending triangle in an uptrend suggests a breakout, while a descending triangle in a downtrend indicates further declines.

Symmetrical triangles show consolidation, with the breakout direction following the pre-existing trend. Flags are small rectangles sloping against the larger trend, representing brief consolidation before the trend continues. Recognizing these patterns aids in making informed trading decisions during consolidation phases.

Tools and Software for Technical Analysis

I rely on several tools and software to conduct technical analysis in crypto trading. These platforms provide essential features, including charting tools, indicators, and real-time data, which help me make informed trading decisions.

TradingView

TradingView offers an intuitive interface with advanced charting tools. It provides various indicators such as:

- Moving Averages,

- RSI

- Bollinger Bands

I also use its social networking features to share ideas and follow other traders.

MetaTrader 4/5

MetaTrader 4 and 5 are popular among forex and crypto traders. I use them for their advanced analytical functions, multiple chart setups, and backtesting options. They support automated trading through Expert Advisors (EAs), enhancing my trading strategies.

Coinigy

Coinigy aggregates data from multiple exchanges into one platform. It offers comprehensive charting tools and a wide range of technical indicators. I use Coinigy to manage my portfolios across different exchanges, reducing the hassle of switching platforms.

CryptoCompare

CryptoCompare supplies real-time and historical data for over 5,300 coins and 240,000 currency pairs. Its unique feature is the extensive data integration, enabling me to analyze market trends and news sentiment alongside technical indicators.

Coinigy

Coinigy aggregates data from multiple exchanges. It offers charting tools and technical indicators. I use Coinigy to manage my portfolios across exchanges, reducing the hassle of switching platforms.

CoinTracking

CoinTracking provides portfolio tracking and tax reporting tools. It imports data from multiple exchanges and wallets. I use it to track my trading performance over time and generate tax reports.

Cryptowatch

Cryptowatch, part of Kraken, offers real-time charting and trading across multiple exchanges. It integrates with other platforms through API keys, giving me a unified trading experience.

Binance

Binance’s trading platform has advanced charts and a variety of tools. I use its extensive range of indicators and drawing tools to perform detailed technical analysis. Its mobile app supports on-the-go trading and analysis.

GeckoTerminal

GeckoTerminal combines on-chain data with technical indicators, offering a unique perspective on market movements. I use its heatmaps and liquidity pool data to identify potential trading opportunities.

These tools and software enhance my ability to conduct technical analysis in crypto trading, equipping me with the insights needed to navigate the volatile crypto market confidently.

Common Mistakes to Avoid

Ignoring Market Trends

Traders often fall into the trap of ignoring overall market trends. Analyzing individual assets without considering the broader market context can lead to misguided decisions. Always align your trades with the prevailing trend to maximize success.

Overtrading

Engaging in too many trades can dilute focus and increase exposure to risk. Prioritize quality over quantity by sticking to well-analyzed opportunities. Excessive trading often leads to higher transaction costs and reduced profitability.

Misinterpreting Indicators

Relying solely on a single indicator can provide a skewed view of the market. Use a combination of indicators like Moving Averages and Bollinger Bands to get a well-rounded analysis. Over-reliance on one tool can result in false signals.

Failing to Set Stop-Loss Orders

Neglecting to set stop-loss orders exposes trades to unnecessary risk. Protect your capital by setting stop-loss levels that automatically close trades at predetermined prices. This reduces potential losses and preserves trading capital.

Emotional Trading

Allowing emotions to drive trading decisions often results in poor outcomes. Maintain discipline by sticking to a well-researched trading plan. Emotional decisions usually lead to premature exits or holding onto losing trades for too long.

Lack of Diversification

Putting all funds into a single crypto asset increases risk. Diversify your portfolio across various assets to manage risks effectively. Even in a bullish market, specific assets can underperform.

Ignoring Risk Management

Effective risk management is crucial for long-term success. Allocate portions of your portfolio based on risk tolerance and market conditions. Ignorance in this aspect can lead to significant financial losses.

Following Crowds Uncritically

Following popular opinions or trends without performing your analysis can be detrimental. Conduct your research to understand the fundamentals and technical aspects before making trading decisions. Blindly following others can lead to unwise investments.

Best Practices for Effective Analysis

Performing effective technical analysis in crypto trading requires adherence to several best practices that enhance accuracy and decision-making.

Use Multiple Indicators

Rely on several indicators to confirm signals. For example, use Moving Averages alongside RSI and MACD to identify consistent trends before making trades.

Set Clear Objectives

Define your trading goals. Determine if you’re aiming for short-term gains or long-term investments, as this influences the analytical techniques used.

Keep Updated with News

Monitor crypto news regularly. Major events can impact market behavior, making it essential to combine technical analysis with fundamental analysis.

Backtest Strategies

Assess strategies using historical data. Platforms like TradingView offer backtesting features that help evaluate the performance of specific indicators before implementing them.

Record and Review Trades

Maintain a trading journal. Document your trades and review them periodically to identify patterns in your decision-making and outcomes.

Adjust to Market Conditions

Adapt your strategies based on market conditions. Whether the market is bullish, bearish, or sideways, modify your approach accordingly.

Manage Risk

Incorporate risk management practices. Set stop-loss orders and determine your risk tolerance level to safeguard your investments.

Consistently applying these best practices fosters efficient technical analysis, aiding in making informed decisions in the dynamic crypto market.

Alice Morillo is a prominent figure at The Digi Chain Exchange, known for her passion and expertise in the field of cryptocurrency and digital finance. With a keen interest in the evolving landscape of blockchain technology, Alice has dedicated herself to providing insightful content that helps both new and seasoned investors navigate the complexities of the crypto world. Her contributions to The Digi Chain Exchange reflect her deep understanding of market trends, trading strategies, and the regulatory environment surrounding digital assets.

Alice Morillo is a prominent figure at The Digi Chain Exchange, known for her passion and expertise in the field of cryptocurrency and digital finance. With a keen interest in the evolving landscape of blockchain technology, Alice has dedicated herself to providing insightful content that helps both new and seasoned investors navigate the complexities of the crypto world. Her contributions to The Digi Chain Exchange reflect her deep understanding of market trends, trading strategies, and the regulatory environment surrounding digital assets.