Understanding NFTs

NFTs, or non-fungible tokens, represent unique digital assets secured on a blockchain. Unlike cryptocurrencies such as Bitcoin or Ethereum, NFTs can’t be exchanged on a one-to-one basis due to their unique properties. These digital tokens can represent anything from digital art to real estate, offering verifiable ownership and authenticity.

Blockchain technology underpins NFTs, ensuring each token’s uniqueness and provenance. The Ethereum blockchain is the most common platform for NFTs due to its smart contract capabilities, which facilitate the creation, sale, and transfer of these tokens securely and transparently.

Several industries now leverage NFTs for various revolutionary applications:

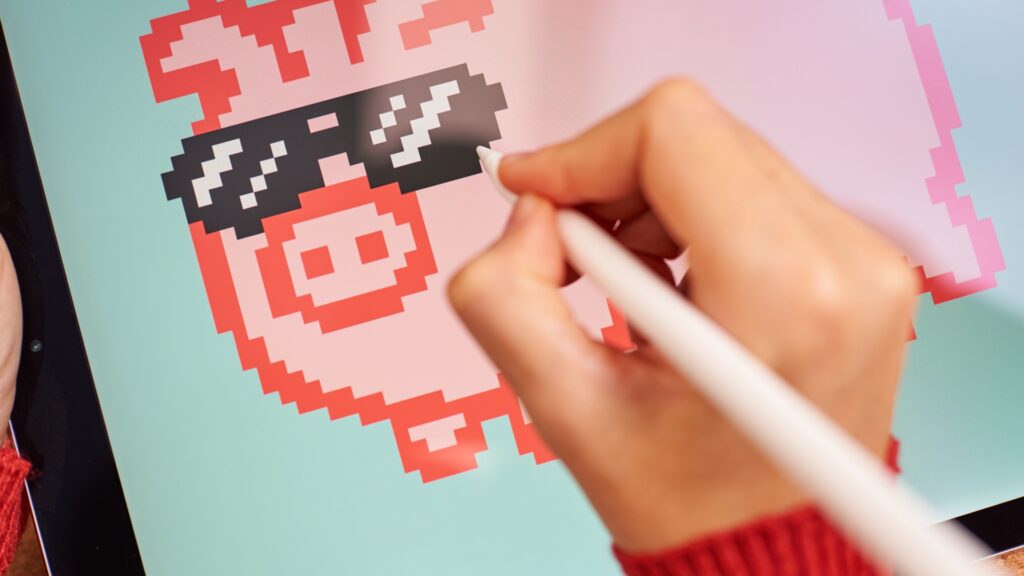

- Art: Artists mint NFTs to sell digital artworks, ensuring originality, scarcity, and royalties.

- Real Estate: Developers use NFTs to tokenize properties, simplifying transactions and allowing fractional ownership.

- Music: Musicians release NFT albums, granting fans exclusive content and ownership rights.

- Gaming: Game developers create NFT-based in-game items that players can trade, sell, or own permanently.

NFTs provide immutable proof of ownership by existing on a blockchain, where no entity can alter or duplicate them.

NFTs in Real Estate

NFTs transform real estate by enabling digital property transactions and ownership verification.

Property Ownership

By tokenizing physical properties, real estate developers create NFTs that represent property ownership. An NFT tied to a specific property can simplify transaction processes, providing a transparent and secure method for property sales. Each token includes essential information about the property, such as legal documents, ownership history, and transaction records.

Virtual Land

NFTs also revolutionize virtual real estate within platforms like Decentraland and The Sandbox. Users purchase, develop, and sell virtual land parcels using NFTs.

These virtual properties hold unique value based on location and development, attracting investors and businesses interested in digital spaces. By leveraging blockchain technology, NFTs ensure ownership rights and prevent fraud in virtual land transactions.

NFTs in Music

Musicians utilize NFTs to transform how they distribute and monetize their work. The blockchain ensures transparency and security in every transaction.

Music Royalties

NFTs streamline the collection and distribution of music royalties. Traditional methods often involve intermediaries, which reduce artists’ earnings and delay payments.

NFTs allow direct transactions, ensuring a fair share for creators and quicker payments. For instance, artists can mint NFTs representing their songs or albums, allowing them to sell partial ownership to fans. These NFTs can include smart contracts that automatically distribute royalties based on predefined terms, ensuring transparency and compliance.

Exclusive Releases

NFTs enable musicians to offer exclusive releases and limited-edition content. Fans purchase unique digital collectibles directly from their favorite artists, fostering a closer connection.

For example, exclusive tracks, behind-the-scenes footage, or virtual concert tickets can be tokenized as NFTs. Musicians like Kings of Leon have released NFT albums, offering special perks like vinyl records and front-row concert tickets. This strategy not only generates revenue but also creates a unique fan experience.

NFTs in Gaming

Non-fungible tokens (NFTs) are revolutionizing the gaming industry. Developers integrate NFTs into games, enabling unique, tradable in-game assets and fostering player-driven economies.

In-Game Assets

NFTs create unparalleled opportunities for in-game assets. Players acquire unique items, such as:

- weapons

- skins

- characters

These digital assets have proven ownership and authenticity, verified on the blockchain.

Axie Infinity and CryptoKitties exemplify how NFTs allow players to buy, sell, and trade assets within and outside the game ecosystem. This enhances gameplay by introducing scarcity and value to digital items.

Player-Driven Economies

NFTs power player-driven economies in gaming. Players generate real-world income by trading NFT assets. This supports a thriving marketplace, where gamers monetize their skills and time investment.

Decentralized platforms like Decentraland enable users to create, trade, and profit from virtual goods and services. Blockchain technology ensures transparent transactions and prevents fraud, cementing trust in these virtual economies.

NFTs in Collectibles

NFTs transform the landscape of digital collectibles, offering unprecedented value and exclusivity.

Digital Trading Cards

Digital trading cards gain popularity through NFT technology, which enhances their authenticity and value. Platforms like NBA Top Shot allow users to buy, sell, and trade officially licensed NBA highlight moments, making each card unique and verifiable. Blockchain ensures card scarcity, preventing duplication and counterfeiting.

CryptoPunks, algorithmically generated pixel art characters, also serve as a prime example of digital collectible success. Their rarity and ownership are immutable, creating a robust market.

Virtual Memorabilia

Virtual memorabilia gains traction with NFTs, providing fans new ways to own pieces of history. Celebrities and athletes release tokenized merchandise, such as signed digital posters or event-specific tokens.

These items are authenticated through blockchain, ensuring provenance. For instance, musicians offer NFT-backed concert tickets, granting owners exclusive access to events or meet-and-greets. This innovation expands the memorabilia market beyond physical items, adding a digital layer of exclusivity and ownership to cherished moments.

Challenges and Considerations

NFTs promise transformative potential in various sectors, but significant challenges persist.

Legal Issues

Legal frameworks for NFTs remain unclear. Intellectual property rights can be difficult to enforce, as ownership of an NFT doesn’t always transfer copyright of the underlying asset. Jurisdictional discrepancies in laws complicate legal enforcement across borders. Regulatory uncertainties lead to complexities in tax implications, with transactions often subject to varied interpretations depending on the region.

Market Volatility

NFT markets experience high volatility. Prices of NFTs can fluctuate drastically due to speculative trading. The illiquidity of some NFTs makes it challenging for sellers to find buyers. Market manipulation, including wash trading, can distort true asset value. Potential for significant financial loss exists, especially for investors with limited understanding of market dynamics.

Ricky Morenolendez is a key contributor at The Digi Chain Exchange, recognized for his deep expertise in cryptocurrency and blockchain technology. With years of experience in analyzing market trends and providing actionable insights, Ricky has become a trusted voice in the crypto space. His work focuses on helping investors understand the nuances of digital assets, from Bitcoin to emerging altcoins. Ricky’s dedication to educating the community on market strategies and crypto developments has made him an invaluable asset to The Digi Chain Exchange team.

Ricky Morenolendez is a key contributor at The Digi Chain Exchange, recognized for his deep expertise in cryptocurrency and blockchain technology. With years of experience in analyzing market trends and providing actionable insights, Ricky has become a trusted voice in the crypto space. His work focuses on helping investors understand the nuances of digital assets, from Bitcoin to emerging altcoins. Ricky’s dedication to educating the community on market strategies and crypto developments has made him an invaluable asset to The Digi Chain Exchange team.