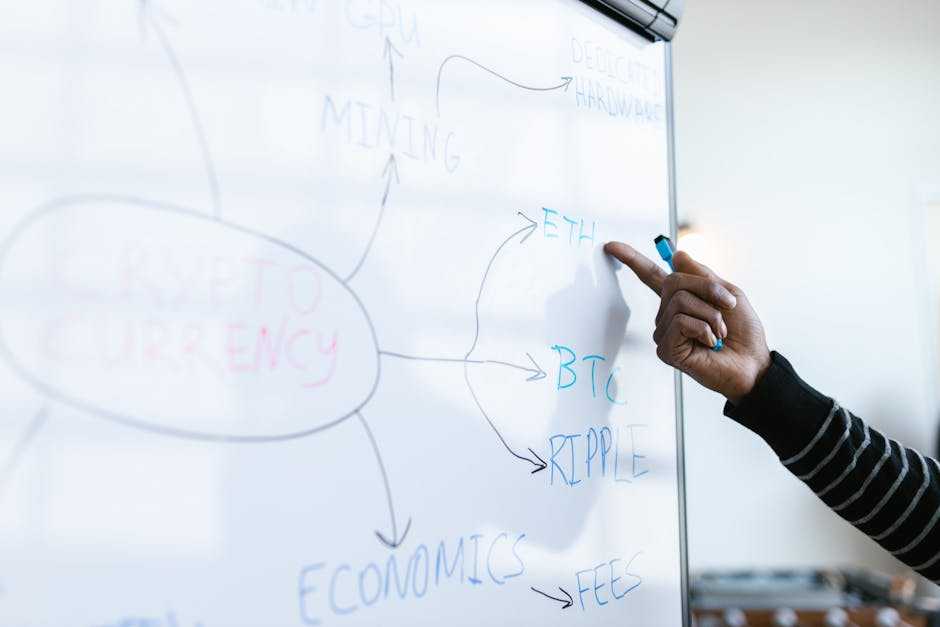

Overview of Institutional Investors in Crypto

Institutional investors like:

- hedge funds

- banks

- asset management

firms are transforming the crypto landscape. These entities manage vast amounts of capital. By entering the crypto market, they’re infusing high levels of liquidity. For example, Grayscale Investments manages over $20 billion in digital assets.

Hedge funds see cryptocurrencies as high-reward, often diversifying their portfolios with assets like Bitcoin. These funds are influenced by market trends and investor sentiment, seeking to capitalize on price movements.

Banks are gradually exploring crypto assets. Institutions like JPMorgan and Goldman Sachs now offer Bitcoin-related services to their clients. This participation adds legitimacy and attracts more conservative investors.

Asset management firms like Fidelity have launched dedicated crypto funds. These firms provide structured investment opportunities for their clients, blending traditional assets with digital currencies.

Institutional involvement brings about a mix of stability and scrutiny. As big players enter the market, regulations become stricter, ensuring better security. Investors also benefit from professional risk management practices.

Institutional investors look beyond short-term gains, focusing on the long-term potential of blockchain technology. This shift promotes sustainable growth within the crypto ecosystem.

The Evolution of Crypto Investments

Cryptocurrency investments have evolved significantly, transforming from a niche interest to a mainstream financial asset.

Early Stages of Cryptocurrency

In 2009, Bitcoin emerged as the world’s first cryptocurrency, created by an entity known as Satoshi Nakamoto. During this period, early adopters primarily consisted of individual enthusiasts and tech-savvy users.

Bitcoin’s value surged from less than a cent in 2010 to over $19,000 by the end of 2017. Ethereum’s launch in 2015 introduced smart contracts, further expanding the possibilities of blockchain technology.

Entrance of Institutional Investors

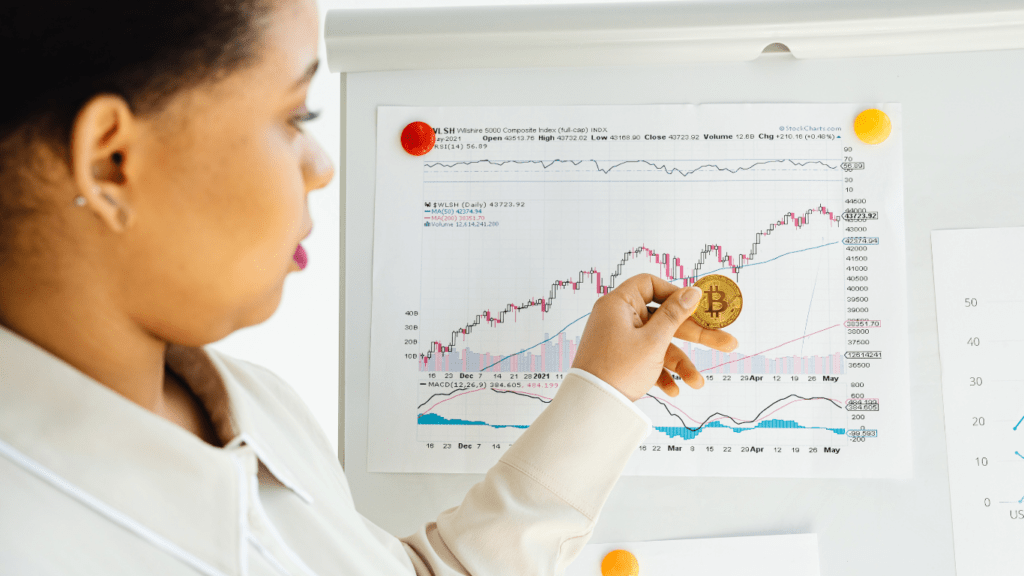

By the late 2010s, institutional investors entered the crypto space. Hedge funds saw Bitcoin and other cryptocurrencies as a hedge against traditional market volatility.

Firms like Grayscale Investments began offering crypto trusts, making it easier for institutional buyers to gain exposure. In 2020, companies like MicroStrategy and Tesla announced substantial Bitcoin purchases, serving as high-profile endorsements of the asset class.

According to a 2021 Fidelity report, 52% of institutional investors globally had some exposure to digital assets, highlighting the significant shift in market dynamics.

Effects on Cryptocurrency Market Dynamics

Institutional investors are reshaping cryptocurrency market dynamics. Their involvement impacts various aspects, enhancing stability and regulatory compliance.

Market Stability and Liquidity

Institutional investors provide significant liquidity, reducing volatility. For example, Grayscale Investments holds over $20 billion in digital assets.

Such large-scale investments create a stable trading environment that minimizes drastic fluctuations. Hedge funds, including Bridgewater Associates, diversify with crypto assets, adding more trading volume and enhancing liquidity.

Regulatory Changes and Compliance

Institutions also bring regulatory scrutiny, driving compliance improvements. Regulatory bodies like the SEC and CFTC evaluate cryptocurrencies due to the rising institutional interest. Firms like JPMorgan comply with these regulations, adhering to stringent guidelines.

This compliance fosters a safer, more regulated trading environment. Major asset managers, including Fidelity, follow regulatory frameworks, ensuring their crypto funds meet legal standards.

Institutional investors’ participation introduces stability and compliance, transforming cryptocurrency markets.

Key Players in Institutional Crypto Investments

Institutional investors have significantly impacted the cryptocurrency market. These key players include financial institutions and hedge funds, among others.

Major Financial Institutions

Major banks and financial institutions play pivotal roles in cryptocurrency investments. JPMorgan, for example, has developed its digital coin for instant payments between institutional accounts. Goldman Sachs offers Bitcoin futures trading, leveraging its established financial infrastructure.

Citibank explores blockchain technology for efficient cross-border transactions. These institutions provide liquidity and credibility, enhancing the market’s stability.

Influential Hedge Funds and Asset Managers

Several hedge funds and asset managers have recognized crypto’s potential. Grayscale Investments manages over $20 billion in digital assets, making it one of the largest crypto investment firms.

Fidelity Digital Assets offers a range of cryptocurrency services, enabling institutional investors to integrate digital assets into their portfolios.

Pantera Capital, an asset management firm, has focused on blockchain ventures since 2013, underscoring its commitment to the sector. These players drive market maturity by offering structured investment opportunities in digital currencies.

Benefits and Risks for Institutional Investors

Institutional investors play a pivotal role in the crypto landscape. Their involvement brings both advantages and challenges.

Portfolio Diversification

Cryptocurrencies offer unique portfolio diversification benefits. They exhibit low correlation with traditional assets like stocks and bonds, reducing overall portfolio risk.

For instance, Bitcoin and Ethereum often respond differently to market dynamics compared to equities. By including digital assets, institutional investors can mitigate portfolio volatility and enhance returns.

Risk Assessment and Management

Effective risk management is crucial for institutions in the crypto space. Volatility remains high despite market maturation. Tools like futures contracts and options help hedge exposure.

Institutions must employ robust risk management strategies, including regular stress testing and scenario analysis, to navigate unpredictable market conditions. Security risks, such as hacking, require stringent cybersecurity measures and insurance coverage to protect assets.

Institutional investors enhance liquidity, credibility, and stability, contributing significantly to the crypto market’s evolution. Balancing benefits and risks is critical to maximizing gains and ensuring long-term success.

Future Prospects of Institutional Involvement

Institutional investors continue to reshape the cryptocurrency market. Their increasing involvement signals significant changes ahead.

Predictions and Trends

Institutional participation will likely grow. Boston Consulting Group predicts that by 2030, up to $16 trillion in assets could be tokenized, reflecting a substantial shift towards digital assets. Cryptocurrencies may become a standard portfolio asset.

More financial products tailored for institutional investors will probably emerge. Products like cryptocurrency ETFs and futures contracts offer new ways to invest.

Demand for regulatory clarity will likely rise, pushing governments to create clearer frameworks. Concurrently, blockchain technology adoption will increase as institutions explore its potential beyond cryptocurrencies, impacting various sectors such as finance, supply chain, and healthcare.

Potential Challenges and Opportunities

- Regulatory uncertainty remains a challenge. Institutions need clear regulations to operate confidently.

- Cybersecurity risks also pose significant threats. Institutions must invest in advanced security measures to protect digital assets.

- However, there are numerous opportunities. Institutional involvement brings greater liquidity and market stability.

- By holding large crypto reserves, institutions can influence market prices positively.

- Strategic diversification into cryptocurrencies can also enhance portfolio performance.

- As institutions adopt blockchain, innovation will likely accelerate, leading to more efficient and transparent systems.

- Institutional investors, weighing challenges and opportunities, will play a crucial role in the future of the cryptocurrency market.

Ricky Morenolendez is a key contributor at The Digi Chain Exchange, recognized for his deep expertise in cryptocurrency and blockchain technology. With years of experience in analyzing market trends and providing actionable insights, Ricky has become a trusted voice in the crypto space. His work focuses on helping investors understand the nuances of digital assets, from Bitcoin to emerging altcoins. Ricky’s dedication to educating the community on market strategies and crypto developments has made him an invaluable asset to The Digi Chain Exchange team.

Ricky Morenolendez is a key contributor at The Digi Chain Exchange, recognized for his deep expertise in cryptocurrency and blockchain technology. With years of experience in analyzing market trends and providing actionable insights, Ricky has become a trusted voice in the crypto space. His work focuses on helping investors understand the nuances of digital assets, from Bitcoin to emerging altcoins. Ricky’s dedication to educating the community on market strategies and crypto developments has made him an invaluable asset to The Digi Chain Exchange team.