What Is Crypto Market Volatility?

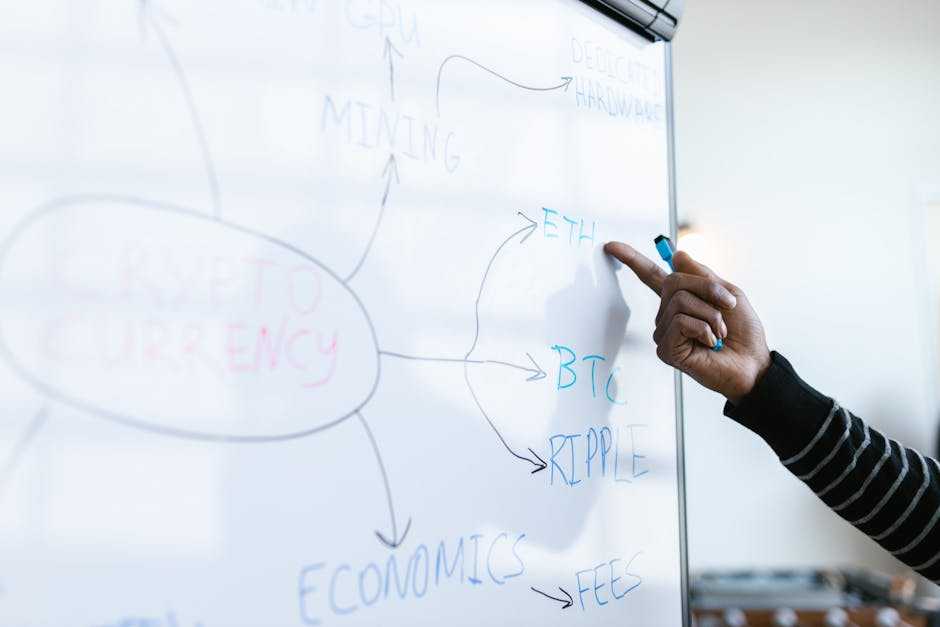

Crypto market volatility describes the rapid and significant price changes in cryptocurrency markets. Unlike traditional assets, cryptocurrencies often experience extreme fluctuations within short time frames. This variability can both create opportunities for high returns and pose risks for substantial losses.

Several factors contribute to crypto market volatility. Market sentiment plays a major role. News about regulations, technology, or security breaches impacts investors’ emotions, causing rapid buy or sell actions. For example, a positive update on a blockchain project can spike prices, while a hacking incident could plummet them.

Liquidity also affects volatility. Cryptocurrencies with lower trading volumes, like altcoins, often experience more volatility due to lesser market depth. When large transactions occur, they can significantly shift prices. Popular cryptocurrencies like Bitcoin and Ethereum, though more liquid, still show notable price swings.

Regulatory news impacts volatility. Governments’ decisions on legal policies or crackdowns can cause panic or elation among investors. An instance of this is China’s cryptocurrency ban, which led to significant market drops in 2021.

Lastly, technological advancements drive volatility. New developments, such as updates to blockchain technology or adoption by major corporations, influence market dynamics. For instance, when PayPal announced support for Bitcoin transactions, prices surged.

Understanding these factors helps in strategizing investments and managing risks in the volatile crypto market.

Key Causes of Crypto Market Volatility

Crypto market volatility arises due to various interconnected factors. Below, I detail the key causes contributing to these rapid price fluctuations.

Speculative Trading

Speculative trading involves buying cryptocurrencies to profit from short-term price movements. This behavior often amplifies volatility, with investors rapidly buying or selling assets based on market trends. High-profile examples include Bitcoin surges and crashes driven by speculative trades.

Market Sentiment and News

Market sentiment and news significantly influence crypto prices. Positive developments like institutional adoption can drive prices up, while negative news like security breaches can cause sharp declines. For example, announcements about regulatory actions or technological failures often lead to immediate market reactions.

Regulatory Changes

Government regulations impact crypto markets profoundly. New laws or regulations can either boost confidence or create uncertainty. Instances include China’s crackdowns on crypto trading or the SEC’s decisions on cryptocurrency classifications, both of which have caused notable market shifts.

Technological Advancements

Advancements in blockchain technology or the introduction of new protocols can affect cryptocurrency values. Major updates like Ethereum’s transition to a proof-of-stake model can lead to price increases due to improved scalability and security.

Market Liquidity

Market liquidity determines how easily assets can be bought or sold without affecting their price. Cryptocurrencies with low liquidity, such as lesser-known altcoins, experience higher volatility. For instance, thinly traded markets can see prices swing wildly with large buy or sell orders.

Effects of Crypto Market Volatility

Crypto market volatility affects various sectors, leading to both opportunities and challenges. Understanding these effects helps navigate the crypto landscape better.

Impact on Investors

Volatility exposes investors to significant profit and loss possibilities. Portfolio values can swing dramatically within short periods, enhancing potential returns but also increasing risk.

This high-risk environment can lead to emotional trading, where knee-jerk reactions to market movements result in substantial financial losses. Diversification, risk management, and staying informed are essential strategies in this volatile market.

Impact on Businesses

Businesses accepting or dealing with cryptocurrencies face operational challenges. Price fluctuations can affect profit margins, requiring constant adjustments in pricing strategies.

Crypto volatility also impacts business planning, as it complicates cash flow management and forecasting. Some businesses use hedging strategies or stablecoins to mitigate these risks, although these tools introduce their own complexities.

Broader Economic Implications

Volatility in the crypto market can influence traditional financial systems. Large price swings can drive increased scrutiny from regulatory bodies, potentially leading to stricter regulations.

Instability in crypto markets can also impact financial stability, especially if more institutions integrate cryptocurrencies into their portfolios. As the crypto market evolves, its volatility continues to shape economic policies and global financial landscapes.

Mitigation Strategies for Crypto Market Volatility

Navigating crypto market volatility requires effective strategies. Below are essential methods to mitigate risks associated with price fluctuations.

Diversification

Diversification spreads investments across various assets to reduce risk. By allocating funds in multiple cryptocurrencies like:

- Bitcoin

- Ethereum

- Ripple

I minimize the impact of a single asset’s price drop. For instance, if Bitcoin’s value decreases, gains in Ethereum or Ripple can offset losses. Diversification also extends beyond crypto, including stocks and bonds to achieve a balanced portfolio.

Hedging Techniques

Hedging techniques involve taking an offsetting position to protect against adverse price movements. Using derivatives like futures and options, I can lock in prices to secure profits or minimize losses.

For example, by purchasing a Bitcoin futures contract, I can set a predetermined price for future sale, shielding against potential declines. Engaging in inverse ETFs and other instruments further aids in managing market risk effectively.

Utilizing Stablecoins

Utilizing stablecoins stabilizes investment portfolios during volatility. Unlike traditional cryptocurrencies, stablecoins like Tether (USDT) or USD Coin (USDC) peg their value to fiat currencies.

During market turbulence, I convert volatile assets to stablecoins, preserving capital. For instance, if market sentiment predicts a downturn, moving funds to USDT ensures value retention, mitigating exposure to significant fluctuations.

Analyzing Historical Volatility Trends

Historical volatility trends in crypto markets provide insights into the nature of these digital assets. By examining past data, I can identify patterns that help predict future fluctuations.

The crypto market, known for its sudden price shifts, often reacts to external stimuli such as regulatory announcements and macroeconomic changes.

From 2013 to 2017, Bitcoin experienced several significant volatility spikes. In late 2013, for example, Bitcoin’s price surged from $200 to over $1,000 within a few months, driven by increased media attention and speculative trading.

Conversely, the 2018 bear market showed how market psychology and panic selling can lead to prolonged downturns, with Bitcoin’s price dropping nearly 70% from its peak in 2017.

Ethereum, another major cryptocurrency, also exhibited notable volatility. During the Initial Coin Offering (ICO) boom of 2017, Ethereum’s price jumped from around $8 to $400 in just six months, influenced by the growing number of projects built on its platform. However, the subsequent regulatory crackdowns on ICOs led to a sharp decline.

A comparative analysis of these trends highlights the cyclical nature of crypto markets. Bull runs often follow periods of technological innovation and increased adoption, while bear markets correspond with regulatory scrutiny and market corrections. By understanding these historical trends, I can better navigate future market movements.

Tools and Resources for Tracking Volatility

Several tools and resources help track crypto market volatility effectively. These provide real-time data and analytical insights essential for informed decision-making.

- Volatility Indexes:

Crypto Volatility Index (CVI): This index measures the expected volatility of cryptocurrencies, similar to the VIX for traditional stock markets. CVI aggregates price data to present a volatility rating.

BitVol Index: This index specifically tracks Bitcoin’s implied volatility over a period. BitVol is useful for investors focusing on Bitcoin. - Price Tracking Platforms:

CoinMarketCap: This platform provides comprehensive data on cryptocurrency prices, market capitalizations, volume, and more. Users can set alerts for price changes.

CoinGecko: CoinGecko offers a broad market overview, including real-time price movements and historical data, illustrating volatility trends over time. - Charting Tools:

TradingView: TradingView offers extensive charting tools and indicators, enabling users to visualize and analyze market trends. It includes features like moving averages and Bollinger Bands.

CryptoCompare: CryptoCompare provides price charts and technical analysis tools. The platform’s detailed visual data aids in spotting volatility patterns. - News Aggregators:

CryptoPanic: CryptoPanic aggregates news from multiple sources, alerting users to events that could impact market volatility. Keeping up with the latest news helps foresee potential market disruptions.

CoinSpectator: CoinSpectator curates crypto news, offering insights into regulatory developments and other factors influencing market stability. - Portfolio Management Tools:

CoinTracking: CoinTracking helps manage crypto portfolios by providing detailed reports on trading, performance, and realized profits. It tracks historical prices and volatility for better portfolio analysis.

Delta: Delta allows users to track their cryptocurrency investments, offering insights into price changes and volatility, which help manage investment strategies.

Employing these tools enhances the understanding and management of crypto market volatility. Each tool or resource provides unique insights, aiding investors in making informed decisions to successfully navigate the volatile crypto landscape.

Ricky Morenolendez is a key contributor at The Digi Chain Exchange, recognized for his deep expertise in cryptocurrency and blockchain technology. With years of experience in analyzing market trends and providing actionable insights, Ricky has become a trusted voice in the crypto space. His work focuses on helping investors understand the nuances of digital assets, from Bitcoin to emerging altcoins. Ricky’s dedication to educating the community on market strategies and crypto developments has made him an invaluable asset to The Digi Chain Exchange team.

Ricky Morenolendez is a key contributor at The Digi Chain Exchange, recognized for his deep expertise in cryptocurrency and blockchain technology. With years of experience in analyzing market trends and providing actionable insights, Ricky has become a trusted voice in the crypto space. His work focuses on helping investors understand the nuances of digital assets, from Bitcoin to emerging altcoins. Ricky’s dedication to educating the community on market strategies and crypto developments has made him an invaluable asset to The Digi Chain Exchange team.