What Are NFTs?

NFTs, or Non-Fungible Tokens, are unique digital assets verified using blockchain technology. Unlike cryptocurrencies like Bitcoin or Ethereum, which are fungible and can be exchanged on a one-to-one basis, NFTs are unique and cannot be replicated. Each NFT represents ownership of a specific item, such as:

- digital art

- music

- video

- virtual real estate

Blockchain technology, the backbone of NFTs, ensures the security and uniqueness of each token. A blockchain acts as a decentralized ledger, tracking the ownership and transfer of NFTs. This structure guarantees that every NFT is authentic and unalterable.

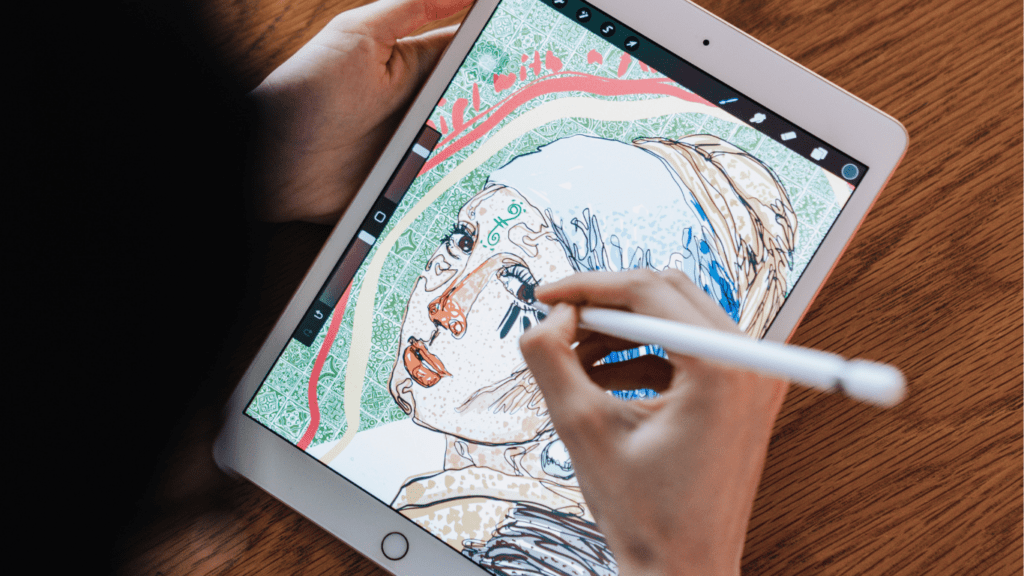

Artists and creators use NFTs to monetize their work by embedding it into a digital token. For example, an artist can tokenize a piece of digital art, creating a one-of-a-kind item that buyers can purchase and own. This method allows creators to sell directly to consumers, bypassing traditional auction houses or galleries.

Various industries are adopting NFTs. In gaming, for instance, NFTs represent in-game assets like weapons, skins, or virtual land plots. These in-game NFTs can be bought, sold, and traded among players, often for significant sums of money.

NFT marketplaces, such as OpenSea, Rarible, and Foundation, facilitate the buying and selling of these tokens. These platforms list thousands of NFTs, providing a space for creators and collectors to connect. Transactions on these platforms often use cryptocurrencies, predominantly Ethereum.

Understanding NFTs involves grasping key concepts like minting, metadata, and smart contracts. Minting refers to creating an NFT on the blockchain, giving it a unique identity. Metadata includes information that describes the NFT, such as the creator’s name, the date of creation, and properties specific to the token. Smart contracts are self-executing contracts with terms directly written into code, governing the sale and ownership transfer of NFTs.

In essence, NFTs have introduced a new paradigm for owning and trading digital assets, offering unprecedented opportunities for artists, investors, and tech enthusiasts.

How NFTs Work

NFTs leverage blockchain technology and cryptocurrencies to create unique digital assets. Understanding these components is crucial for grasping the functionality of NFTs.

Blockchain Technology

NFTs exist on blockchain networks, which act as decentralized ledgers, ensuring security and authenticity. Each NFT contains distinct information verified and stored across multiple nodes within the network.

When an NFT is created, or “minted,” a specific record is added to the blockchain detailing its unique properties, ownership, and transaction history. Platforms like Ethereum use smart contracts to automate and enforce these transactions, reducing the chance of fraud and tampering.

Cryptocurrency Connection

NFTs are typically bought and sold using cryptocurrencies, primarily Ethereum. Transactions occur on NFT marketplaces like OpenSea and Rarible, where buyers use their crypto wallets to purchase these digital tokens.

The relationship between NFTs and cryptocurrencies ensures a seamless and efficient exchange of value. Both rely on blockchain for transparency and security, making them integral to the evolving digital economy.

Types of NFTs

NFTs encompass a wide range of categories, each offering unique value propositions to creators and collectors.

Art and Collectibles

Art and collectibles dominate the NFT market. Digital art pieces like Beeple’s “Everydays: The First 5000 Days” have fetched millions of dollars. Collectibles, including CryptoPunks and Bored Ape Yacht Club, are popular among enthusiasts. Each piece is unique, with ownership verified through blockchain technology, ensuring authenticity and scarcity.

Virtual Real Estate

Virtual real estate offers digital property ownership in metaverses like Decentraland and The Sandbox. Users buy, sell, and develop plots of land, creating unique experiences and environments. The value of virtual real estate often depends on location, development, and overall demand within the virtual world.

Music and Media

Musicians and media creators use NFTs to monetize their work. Artists like Kings of Leon and Grimes have released albums and exclusive content as NFTs. Media NFTs include video clips, GIFs, and digital memorabilia. Blockchain technology ensures artists retain ownership rights, and fans gain exclusive, verifiable access to content.

How to Buy and Sell NFTs

Buying and selling NFTs involves using specific platforms and digital wallets. The process is straightforward but requires understanding the tools and steps involved.

Popular Marketplaces

Popular NFT marketplaces like OpenSea, Rarible, and Foundation host various digital assets for sale.

- OpenSea offers a broad range of NFTs, including digital art, collectibles, and virtual land.

- Rarible allows creators to mint their own NFTs, making it ideal for artists looking to sell their work.

- Foundation focuses on high-quality digital art, often featuring limited-edition works from renowned artists.

Each marketplace supports different types of NFTs and provides unique features for buyers and sellers.

Wallet Setup and Security

A digital wallet is essential for storing and transacting NFTs securely.

- Create a Wallet: Use wallets like MetaMask or Trust Wallet to manage your NFTs. These wallets store your private keys and connect to your chosen marketplace.

- Secure Your Wallet: Enable two-factor authentication (2FA) and back up your wallet’s seed phrase in a secure location. This ensures only you can access your assets.

- Transfer Funds: Load your wallet with cryptocurrency, typically Ethereum, to make purchases. This involves transferring funds from an exchange like Coinbase to your wallet.

By setting up a secure digital wallet and using reputable marketplaces, you can confidently buy and sell NFTs.

The Pros and Cons of NFTs

NFTs offer unique opportunities and challenges in the digital landscape, affecting creators, collectors, and investors.

Benefits

- Ownership Verification: NFTs provide tamper-proof proof of ownership through blockchain, ensuring authenticity. For example, buyers know their digital art is original when tokens are unique.

- Royalty Payments: Smart contracts can automate royalty payments to creators on each resale. Artists benefit financially every time their work changes hands, which galleries often do not facilitate traditionally.

- New Revenue Streams: NFTs open new monetization avenues for creators. Digital artists, musicians, and game developers can generate income by tokenizing their work and selling it directly to fans.

- Community Engagement: NFTs allow creators to engage directly with their audience. Exclusive token drops can foster stronger fan relationships, increasing loyalty and support.

Potential Drawbacks

- Environmental Concerns: NFT transactions, primarily on blockchain networks like Ethereum, consume significant energy. This high energy usage contributes to carbon emissions, raising environmental sustainability issues.

- Market Volatility: NFT values can be highly volatile. Prices fluctuate rapidly, making it hard for investors to predict long-term value, similar to cryptocurrency market behaviors.

- Scams and Fraud: The nascent NFT market attracts bad actors. Scams and counterfeit tokens are common, and it’s crucial to verify the legitimacy of sellers and tokens through trusted platforms.

- Accessibility: High transaction fees on blockchain networks can be a barrier. Additionally, not everyone is familiar with the technical aspects of setting up digital wallets and navigating NFT marketplaces.

The Future of NFTs

Non-fungible tokens (NFTs) continue evolving rapidly, creating new possibilities while facing challenges. Let’s explore these market trends and opportunities.

Market Trends

NFT market trends reflect significant growth and interest diversification. Data from NonFungible.com shows NFT sales surged from $100 million in 2020 to over $2 billion in Q1 2021.

Art, collectibles, gaming, and virtual land drive much of this demand. High-profile artists like Beeple and platforms like NBA Top Shot attract widespread attention, drawing more creators and buyers into the space.

New use cases emerge as NFTs expand beyond digital art. Fashion brands like Gucci explore virtual wearables, while music artists tokenize albums.

Real-world assets, such as real estate, get tokenized for fractional ownership, broadening NFT applications. Interoperable standards and cross-chain solutions like Polkadot enhance ecosystem integration, ensuring NFTs work seamlessly across platforms.

Challenges and Opportunities

NFT adoption faces significant challenges. Environmental concerns persist due to Ethereum’s high energy consumption. Transitioning to Ethereum 2.0 and alternative eco-friendly blockchains like Tezos promises sustainability.

Market volatility and speculative risks deter some investors, but regulatory clarity can mitigate uncertainties.

Opportunities in the NFT space abound. Smart contracts facilitate ongoing royalties, providing artists with passive income. Increased accessibility through user-friendly platforms and lower fees expands market participation.

Partnerships and collaborations across industries generate innovative NFT applications, promising continuous growth and engagement.

NFTs present a dynamic future with evolving trends and opportunities, balancing challenges to revolutionize digital ownership and commerce.

Ricky Morenolendez is a key contributor at The Digi Chain Exchange, recognized for his deep expertise in cryptocurrency and blockchain technology. With years of experience in analyzing market trends and providing actionable insights, Ricky has become a trusted voice in the crypto space. His work focuses on helping investors understand the nuances of digital assets, from Bitcoin to emerging altcoins. Ricky’s dedication to educating the community on market strategies and crypto developments has made him an invaluable asset to The Digi Chain Exchange team.

Ricky Morenolendez is a key contributor at The Digi Chain Exchange, recognized for his deep expertise in cryptocurrency and blockchain technology. With years of experience in analyzing market trends and providing actionable insights, Ricky has become a trusted voice in the crypto space. His work focuses on helping investors understand the nuances of digital assets, from Bitcoin to emerging altcoins. Ricky’s dedication to educating the community on market strategies and crypto developments has made him an invaluable asset to The Digi Chain Exchange team.