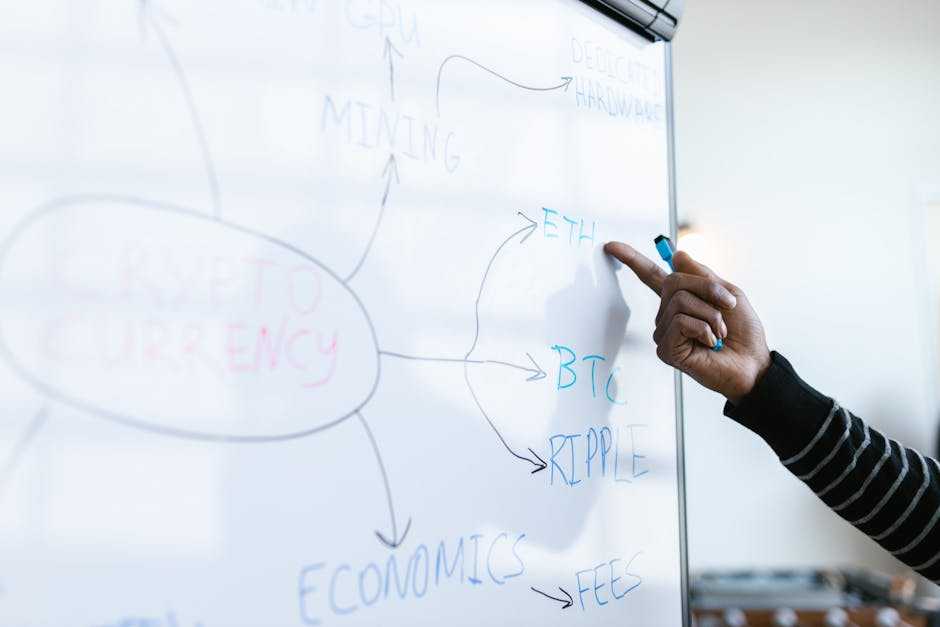

Overview of the Crypto Market in 2024

The crypto market in 2024 features several key trends shaping the landscape. Mainstream integration of digital currencies continues, with increasing acceptance by financial institutions and merchants. Both retail and institutional investors see value in incorporating cryptocurrencies into their portfolios.

Rise of Decentralized Finance (DeFi)

DeFi expands rapidly. Platforms offering decentralized exchanges, lending, and yield farming gain traction. Users see benefits in reduced fees and increased transparency.

Increased Blockchain Adoption by Corporations

Major corporations integrate blockchain technology into their operations. Supply chain management, logistics, and smart contracts see improvements. This adoption enhances security and efficiency.

Regulatory Developments

Governments worldwide update regulations. New frameworks aim to balance innovation with consumer protection. Clearer guidelines emerge, reducing uncertainty for investors.

Technological Advancements

Technological advances continue. Layer 2 solutions, like the Lightning Network, address scalability issues. Enhanced security features protect against cyber threats.

Growing Popularity of NFTs

Non-fungible tokens (NFTs) remain popular. Digital art, collectibles, and gaming assets exchange hands increasingly. Marketplaces and platforms supporting NFTs expand.

Shift Towards Green Energy

Eco-friendly practices gain importance. Mining operations shift towards renewable energy sources. Projects emphasizing sustainability attract more attention.

Influence of Institutional Investment

Institutional investment rises. Major financial institutions, including hedge funds and endowments, allocate more resources to crypto. Their involvement legitimizes the market further.

Cross-border Transaction Facilitation

Cryptocurrencies simplify cross-border transactions. Lower fees and faster transfer times benefit international trade. Businesses and individuals utilize crypto for efficient payments.

These trends illustrate the evolving dynamics and growing maturity of the crypto market. Investors and enthusiasts must stay informed to navigate this ever-changing landscape.

Major Market Trends

In 2024, several crucial trends will shape the crypto market. Understanding these trends helps navigate the dynamic landscape.

Decentralized Finance (DeFi) Expansion

DeFi continues to redefine financial services by eliminating intermediaries. Smart contracts on platforms like Ethereum streamline processes. Aave and Uniswap, for example, offer decentralized lending and trading respectively, showcasing DeFi’s growing utility. As DeFi expands, expect innovations in borrowing, lending, and staking products.

Growing Institutional Adoption

Institutional interest in cryptocurrencies is increasing. Companies like:

- MicroStrategy

- Tesla

hold significant bitcoin reserves, highlighting this trend. Hedge funds, investment banks, and pension funds are also incorporating crypto into their portfolios. The adoption by major firms provides market legitimacy and enhances liquidity.

Regulatory Developments

Regulatory frameworks for cryptocurrencies are evolving. The U.S. Securities and Exchange Commission (SEC) and the European Union are crafting policies to govern digital assets. Compliance with know-your-customer (KYC) and anti-money laundering (AML) regulations is becoming mandatory. These developments create a more secure investment environment but may also impact market dynamics.

Technological Innovations

Emerging technological innovations continue transforming the cryptocurrency landscape. Advancements in blockchain and Layer 2 solutions are particularly noteworthy.

Developments in Blockchain Technology

Blockchain technology’s continuous evolution streamlines transactions and enhances security. In 2024, quantum-resistant algorithms gain traction to safeguard against potential quantum computing threats. Enhanced interoperability solutions like Polkadot and Cosmos improve cooperation between different blockchains, fostering a more integrated ecosystem. Moreover, privacy-focused technologies such as zero-knowledge proofs advance, providing users greater anonymity and security.

Rise of Layer 2 Solutions

Layer 2 solutions alleviate congestion and reduce transaction costs on primary blockchains. Platforms such as Lightning Network for Bitcoin and Optimistic Rollups for Ethereum gain popularity.

These solutions boost transaction speeds and scalability, making cryptocurrencies more accessible for everyday use. Additionally, the development of zk-Rollups, with their ability to handle large transaction volumes off-chain, becomes crucial in supporting the burgeoning DeFi sector.

Emerging Cryptocurrencies to Watch

As the crypto market evolves, new digital currencies frequently emerge, capturing the attention of investors. In 2024, several promising projects stand out and merit close observation.

Promising New Projects

Several new projects have shown potential in 2024. One such project is Casper (CSPR), a blockchain platform focused on enterprise adoption that offers a unique Proof-of-Stake consensus algorithm. Another notable entrant is Mina Protocol (MINA), known as the lightest blockchain.

It reduces computational requirements, enabling greater decentralization. Meanwhile, Velas (VLX) combines the best features of Solana and Ethereum, promising higher speeds and improved security for decentralized applications (dApps).

Performance of Stablecoins

Stablecoins play a crucial role in the cryptocurrency market by providing stability. Tether (USDT) remains a favorite due to its liquidity and wide acceptance. USD Coin (USDC) continues to grow, driven by transparency and regulatory compliance.

Another noteworthy addition is DAI, a decentralized stablecoin that retains its peg to the US dollar via smart contracts, offering a trustless alternative. These stablecoins help mitigate volatility, making them essential for traders and investors.

Market Predictions and Insights

Crypto market trends in 2024 show promise and uncertainty. Experts offer mixed predictions on the future trajectory of digital currencies.

Expert Opinions

- Analysts from JPMorgan and Goldman Sachs foresee Bitcoin surpassing $100,000 by Q3 2024 due to increasing institutional investments.

- In contrast, economists from MIT argue that regulatory hurdles could slow adoption, highlighting the need for diversified portfolios.

- Blockchain developers predict enhanced security protocols and quantum-resistant technologies will revolutionize decentralized applications, proposing significant growth for platforms like Ethereum and Polkadot.

Potential Challenges and Risks

- Scalability issues, particularly with Ethereum, threaten transaction efficiency and network speed, potentially hampering widespread use.

- Regulatory changes in major economies could lead to market volatility and uncertainty, which might deter new investors.

- Cybersecurity remains a major concern, as sophisticated hacking attempts continue to evolve, targeting both exchanges and individual wallets.

- Cooperation among global regulators will be crucial if the crypto industry is to experience sustainable growth.

Ricky Morenolendez is a key contributor at The Digi Chain Exchange, recognized for his deep expertise in cryptocurrency and blockchain technology. With years of experience in analyzing market trends and providing actionable insights, Ricky has become a trusted voice in the crypto space. His work focuses on helping investors understand the nuances of digital assets, from Bitcoin to emerging altcoins. Ricky’s dedication to educating the community on market strategies and crypto developments has made him an invaluable asset to The Digi Chain Exchange team.

Ricky Morenolendez is a key contributor at The Digi Chain Exchange, recognized for his deep expertise in cryptocurrency and blockchain technology. With years of experience in analyzing market trends and providing actionable insights, Ricky has become a trusted voice in the crypto space. His work focuses on helping investors understand the nuances of digital assets, from Bitcoin to emerging altcoins. Ricky’s dedication to educating the community on market strategies and crypto developments has made him an invaluable asset to The Digi Chain Exchange team.