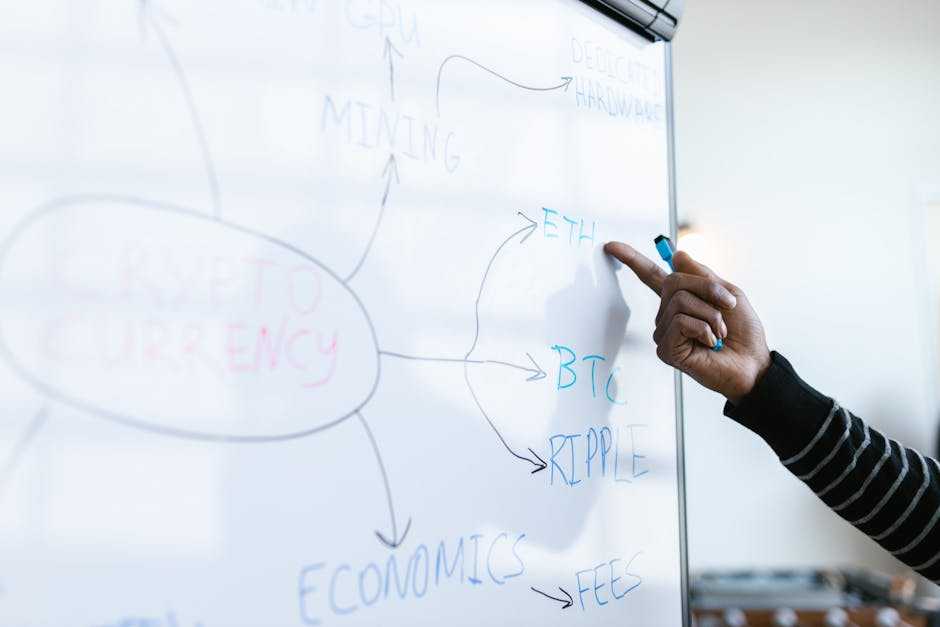

Understanding Crypto Market Sentiment

Crypto market sentiment involves the overall attitude of investors toward cryptocurrency assets. Sentiment influences price movements and volatility, making it crucial for investors to comprehend.

Definition and Importance

Market sentiment represents the collective mood and emotions of investors regarding cryptocurrency. Positive sentiment usually indicates optimism, driving prices up, while negative sentiment signals pessimism, pushing prices down.

Understanding sentiment helps investors make informed decisions and navigate market fluctuations. Tools like sentiment analysis can quantify feelings from social media, news, and trading volumes, offering insights into future price trends.

Historical Context

Crypto market sentiment has evolved with cryptocurrency’s growth. Bitcoin’s launch in 2009 marked the beginning of a new asset class, leading to heightened speculation.

Events like Mt. Gox’s hack in 2014 and the 2017 ICO boom shifted sentiment significantly. Positive regulatory news, technological advancements, and increased institutional adoption have also influenced market moods. By studying past sentiment shifts alongside historical events, investors can better predict and react to current market dynamics.

Tools for Gauging Market Sentiment

Various tools help investors understand crypto market sentiment. These tools offer different perspectives, from social media trends to algorithmic analyses.

Social Media Analysis

Social media platforms provide invaluable data for gauging market sentiment. I rely on tools like TweetDeck and Hootsuite to track real-time discussions on Twitter. These platforms help to identify trending topics and sentiments among crypto enthusiasts. By analyzing the volume and tone of these discussions, one can detect shifts in sentiment before they reflect in the market.

Sentiment Analysis Algorithms

Sentiment analysis algorithms process vast amounts of data to detect market sentiment. Tools like Google Cloud Natural Language API and Lexalytics analyze news articles, social media posts, and other textual content to give sentiment scores. I use these sentiment scores to quantify sentiment trends, allowing for data-driven investment decisions. These algorithms employ machine learning models to accurately gauge sentiment, providing an edge in volatile markets.

Market Sentiment Indices

Market sentiment indices aggregate data to offer a snapshot of investor sentiment. Two popular indices are the Crypto Fear & Greed Index and the Sentix Crypto Index. The Crypto Fear & Greed Index analyzes factors like:

- volatility

- market momentum,

- social media trends

to determine overall market sentiment on a scale from 0 (Extreme Fear) to 100 (Extreme Greed). These indices provide a quick, reliable gauge of market sentiment, helping identify potential turning points or confirm trends.

Key Indicators of Market Sentiment

Understanding market sentiment requires recognizing key indicators that reflect collective investor emotions and behaviors. These indicators provide valuable insights into market dynamics.

Trading Volume and Price Movements

Trading volume and price movements often indicate market sentiment directly. High trading volume during a price increase generally shows positive sentiment. Conversely, high volume during a price drop signals negative sentiment. Tracking these metrics can reveal trends in real-time.

News and Media Influence

News and media significantly affect crypto market sentiment. Announcements of regulatory changes, endorsements from influential figures, or security breaches often lead to rapid sentiment shifts. Monitoring news sources helps anticipate these changes and react accordingly.

Community Sentiment on Forums

Forums like Reddit and Bitcointalk offer valuable insights into community sentiment. Positive discussions and high engagement levels usually reflect a bullish sentiment. Negative posts and disengagement often suggest bearish sentiment. Analyzing these conversations provides a grassroots view of market sentiment.

Strategies for Responding to Market Sentiment

Grasping market sentiment is vital in the crypto world. Here, I explore strategies to respond effectively.

Trading Strategies

My approach involves leveraging sentiment indicators to make short-term trades. High positive sentiment often signals an impending price surge, making it an ideal time to buy.

Conversely, negative sentiment usually precedes price drops, so selling during these times minimizes losses. Tools like TweetDeck help track real-time sentiment shifts. I rely on sentiment analysis algorithms for quick decisions based on collective market emotions.

Long-Term Investment Decisions

For long-term investments, I focus on fundamental sentiment. Sustained positive sentiment around a cryptocurrency, backed by strong project fundamentals, often indicates long-term growth potential.

To gauge this, I use indices like the Crypto Fear & Greed Index. I also monitor community sentiment on Reddit for insights into long-term investor confidence. This blend of sentiment and fundamentals aids in holding or acquiring assets with promising futures.

Risk Management

Market sentiment significantly influences risk management strategies. Sudden negative sentiment spikes often lead to increased volatility. To mitigate risks, I employ stop-loss orders to limit potential losses during downturns.

Diversification is another key strategy, balancing sentiment-driven decisions with stable assets. Tools like Hootsuite provide ongoing sentiment updates, enabling timely adjustments to risk management practices.

Common Pitfalls and How to Avoid Them

Many traders often stumble upon common mistakes when interpreting and responding to market sentiment.

Overreacting to Market Sentiment

- Overreacting to market sentiment leads to impulsive decisions.

- Panic selling during a market downturn or buying during a rally without a strategic plan often results in losses.

- To avoid this, use sentiment indicators in combination with technical and fundamental analyses before executing trades.

- Relying solely on sentiment can create opportunities for errors and emotional trading.

- Setting predefined entry and exit points to mitigate impulsive decisions driven by sentiment alone.

Ignoring Fundamental Analysis

Ignoring fundamental analysis risks blind spots in decision-making. While sentiment provides valuable insights, it’s crucial also to consider a cryptocurrency’s intrinsic value and real-world application. For example, projects with strong development teams, solid use cases, and clear roadmaps often sustain longer-term gains despite short-term sentiment fluctuations.

I review whitepapers, team credentials, and project updates to ensure a robust understanding of the fundamental value backing my investments. Balancing sentiment with sound fundamental analysis enhances decision-making accuracy and long-term portfolio resilience.

Is the innovative founder of The Digi Chain Exchange, a comprehensive platform dedicated to educating and empowering individuals in the world of digital finance. With a strong academic background in Finance and Computer Science from the University of Michigan, Scotterrin began her career in traditional finance before shifting her focus to blockchain technology and cryptocurrencies. An early adopter of Bitcoin and Ethereum, Adaha’s deep understanding of the transformative potential of blockchain led her to create The Digi Chain Exchange, which has since become a trusted resource for crypto news, market trends, and investment strategies.

Is the innovative founder of The Digi Chain Exchange, a comprehensive platform dedicated to educating and empowering individuals in the world of digital finance. With a strong academic background in Finance and Computer Science from the University of Michigan, Scotterrin began her career in traditional finance before shifting her focus to blockchain technology and cryptocurrencies. An early adopter of Bitcoin and Ethereum, Adaha’s deep understanding of the transformative potential of blockchain led her to create The Digi Chain Exchange, which has since become a trusted resource for crypto news, market trends, and investment strategies.