What Volatility Really Means in Crypto

In traditional finance, volatility is basically a measurement of risk. It tells you how much an asset’s price swings over a period of time. Stocks, bonds, commodities all of them follow some level of predictable fluctuation, usually tied to earnings, economic data, or policy changes. Most investors are used to daily ups and downs in the 1 2% range on major assets.

Crypto doesn’t play by those rules. Volatility here is amplified. A token moving 10% in a single day is common, and double digit price swings within hours aren’t rare. This level of movement reflects how young, speculative, and unregulated the market still is. Add in the fact that crypto trades 24/7 globally with no “off” switch for weekends or holidays and the potential for extreme spikes or dips only increases.

What drives this volatility? A few things: thin liquidity (meaning a small number of trades can shift prices a lot), the influence of social media and news cycles, lack of mature institutional anchors, and a trader base often driven more by emotion than fundamentals.

For traders, this means opportunity if you know how to surf the waves. But it also means higher risk and the constant need for tight discipline and active management. For long term holders (HODLers), it requires a strong stomach and a long view. And for institutions? Volatility is both a red flag and a potential reward. They want exposure, but only once the risk is mapped and managed.

In short: crypto volatility is part of the game. It creates the boom but also the bust.

Key Drivers Behind the Boom Bust Cycles

Crypto prices don’t move in straight lines. They spike hard, crash harder, and sometimes hover in a surreal stillness. At the core of this rollercoaster are a few key drivers and understanding them gives you a fighting chance at navigating the chaos.

Speculation is king in crypto. Narrative alone can move billions. A tweet, a rumor, a whiff of adoption potential and suddenly a coin is up 40%. Utility matters, sure. But in the short term, price action is almost always speculation fueled. Long term value needs function and adoption. Short term pumps? Just hype and timing.

Then there’s supply. Most coins are hard capped, and that scarcity creates built in tension. Add in halving events like Bitcoin’s quadrennial supply cut and you get a textbook setup: diminishing supply meets rising demand. People pile in, expecting prices to go vertical. Sometimes they’re right. Other times, the market shrugs.

Zooming out further, macroeconomic forces quietly shape crypto’s trajectory. When interest rates climb, risky assets like crypto tend to bleed. Inflation flaring? Some investors look to Bitcoin as digital gold. A strong U.S. dollar can suppress crypto prices across the board. It’s all connected, even if the charts don’t always show the nuance.

Finally, regulation is the wild card. A single line in a press release from the SEC or European Central Bank can trigger whipsaw moves. Traders hate uncertainty, and the legal gray zone around tokens acts like gasoline on fire. The threat or promise of clarity can send markets soaring or spiraling in minutes.

So what really drives crypto? The truth: all of it. Hype, scarcity, global economics, and headlines all take turns behind the wheel. And the market reacts fast so awareness isn’t optional, it’s essential.

Reading the Charts: Real Volatility Data

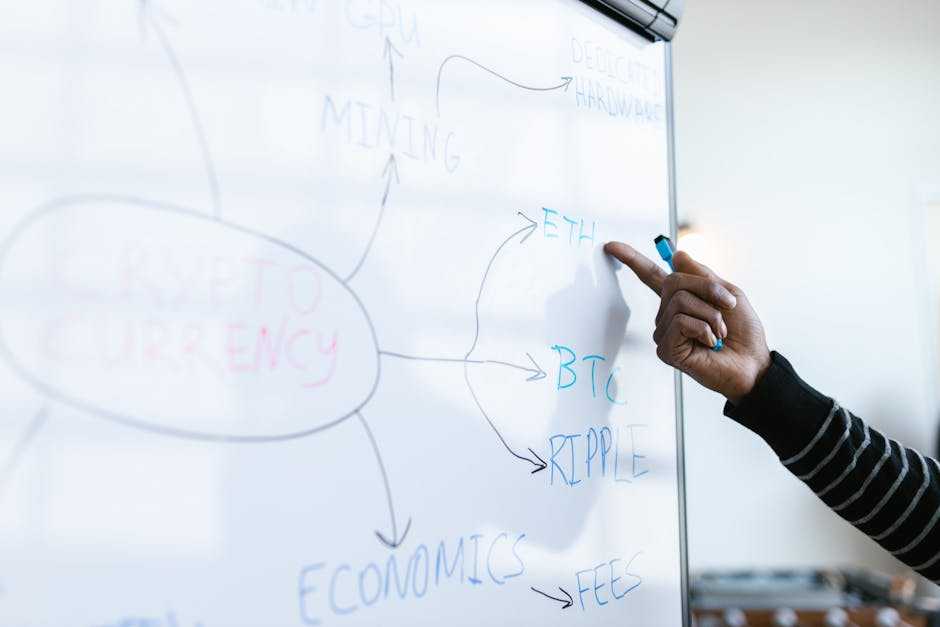

The best way to understand crypto volatility is to look at the data clean, hard charts that don’t lie. Bitcoin (BTC) and Ethereum (ETH) have the longest, most telling price histories. BTC has shown multiple boom bust cycles since 2013, often driven by halving events and macro triggers. ETH mirrors some of this behavior but adds layers of complexity tied to smart contracts and dApp activity. What you’ll notice when you zoom out: Bitcoin’s major moves tend to lead the rest of the market, with ETH and altcoins catching the aftershocks.

Altcoins are a different beast altogether. Their volatility is more explosive quick 200% runs followed by 70% collapses aren’t rare. Look at coins like Solana or Avalanche in 2021 2022, and you’ll get the picture. Historical comparisons show that smaller caps outpace Bitcoin in both directions: higher spikes, deeper crashes.

Volatility indexes (like BitVol for Bitcoin or ETHV for Ethereum) help you anticipate these swings. They measure expected price fluctuations over a set period higher index readings often signal upcoming turbulence. When these indexes spike while prices are rallying, it’s usually a sign of overheated sentiment. When they rise during corrections, it often precedes a breakdown or bounce.

Then there are patterns. Watch for reversals like head and shoulders or double bottoms they’re common signals that momentum is shifting. Moving average crossovers and RSI divergence, though not foolproof, often mark inflection points. The real key is layering this chart data with an eye for momentum: when volume and price move together sharply in a new direction, something’s about to break.

No single signal tells the whole story. But with enough chart time, these patterns stop being noise and start becoming warnings or opportunities.

The Role of Market Sentiment

Crypto isn’t just about math and code. It’s about feelings lots of them. Fear and greed drive the market more than most people like to admit. When prices pump, greed kicks in. Traders scramble to buy, afraid of missing the next moonshot. Then it all flips. News breaks, price dips, and panic selling snowballs. The cycle repeats often faster than you’d see in traditional markets.

FOMO (fear of missing out) and panic are two sides of the same unstable coin. They turn small moves into full blown swings. One influencer tweet, a hack, or sudden bullish news can trigger extreme reactions. It’s not rational but it’s real.

Understanding these emotion fueled patterns is just as crucial as reading charts or analyzing fundamentals. Smart traders use sentiment data like any other signal. They know when the market is overheating and when fear is handing out discounts.

For a sharper look into how to track and respond to these emotional shifts, check out this crypto sentiment insight.

Forecasting Future Fluctuations

Let’s get one thing out of the way no one can perfectly predict the crypto market. It’s not a puzzle you solve once. Instead, the best minds rely on probability models. These tools don’t hand out guarantees, but they help traders and analysts map potential threats and opportunities. Think scenario planning over crystal balls.

One edge in this game comes from on chain metrics. These are raw blockchain data points wallet flows, active addresses, exchange reserves that tell you what people are actually doing with their coins. Are whales accumulating? Are coins being moved to cold storage? That data doesn’t scream direction, but it lays out the mood.

Another stabilizing force? Institutional adoption. As more funds and corporate treasuries hold crypto, price swings get a little less violent. Big players don’t usually sell on a whim and they tend to hedge, not panic. That’s good news for long term outlooks, even if it makes the Wild West feel more like Wall Street.

Finally, zoom out. Global interest rates, inflation numbers, and central bank policies have started casting real shadows over crypto markets. Bitcoin isn’t in its own world anymore it dances to the same macro beats as tech stocks and commodities. When money tightens, risk assets tighten slower. Crypto isn’t immune.

Bottom line: no perfect forecasts, but enough signals to move smartly.

Navigating the Chaos: Actionable Strategies

Trading crypto isn’t about predicting the future it’s about surviving the present. Volatility can chew up undisciplined traders fast. A consistent approach beats gut instinct, which is why dollar cost averaging (DCA) stays popular. DCA means you invest the same amount at regular intervals, smoothing out price swings. It may not be flashy, but it protects you from going all in at the wrong moment.

On the flip side, market timing is what many dream of but rarely get right. Catching tops and bottoms sounds great until you realize the market doesn’t send invites. For most, trying to time entries adds stress and risk without better returns. If you’re going active, have a system and stick to it.

Risk management is where things get real. Use stop losses like seatbelts. They won’t prevent crashes, but they’ll limit damage. Just as importantly, take profits. Greed kills trades. Setting clear targets before you enter keeps emotions in check when things heat up.

Mindset matters. The best traders don’t panic when prices swing hard they prepare for it. That means managing exposure, sleeping well, and understanding that red days happen. If you’re riding every tick emotionally, it’s time to scale back.

Sentiment data adds another layer of edge. Crowd emotions move markets fear dumps prices, euphoria inflates them. Watching sentiment metrics can help your entry and exit timing. Tools that gauge social buzz, funding rates, and position flows give clues about when to lean in or back out.

For a deeper breakdown of how emotions impact price action, revisit this detailed primer on crypto sentiment insight. Use it not just to react but to anticipate.

In short: have a plan. Stick to it. And respect the math more than the hype.

Alice Morillo is a prominent figure at The Digi Chain Exchange, known for her passion and expertise in the field of cryptocurrency and digital finance. With a keen interest in the evolving landscape of blockchain technology, Alice has dedicated herself to providing insightful content that helps both new and seasoned investors navigate the complexities of the crypto world. Her contributions to The Digi Chain Exchange reflect her deep understanding of market trends, trading strategies, and the regulatory environment surrounding digital assets.

Alice Morillo is a prominent figure at The Digi Chain Exchange, known for her passion and expertise in the field of cryptocurrency and digital finance. With a keen interest in the evolving landscape of blockchain technology, Alice has dedicated herself to providing insightful content that helps both new and seasoned investors navigate the complexities of the crypto world. Her contributions to The Digi Chain Exchange reflect her deep understanding of market trends, trading strategies, and the regulatory environment surrounding digital assets.