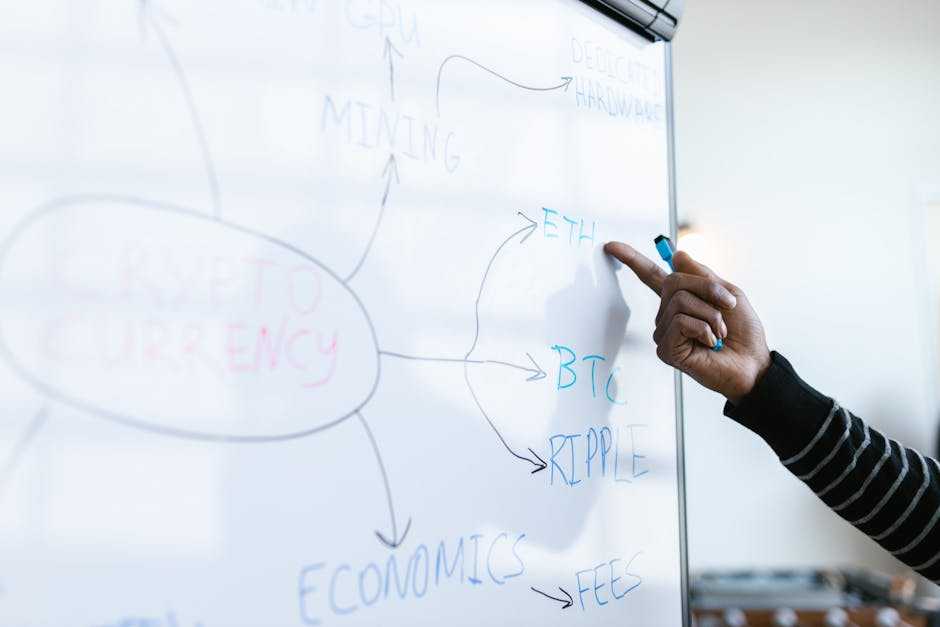

Overview Of The Monthly Crypto Market

The past month saw significant developments in the crypto market. Key trends included notable price fluctuations, regulatory shifts, and technological innovations.

Bitcoin’s price showed volatility, experiencing a 10% drop in the first week followed by a gradual recovery. Ethereum followed a similar path, with a notable spike mid-month due to an upgrade announcement.

Regulatory Shifts

Several countries introduced or amended crypto regulations. The US Securities and Exchange Commission (SEC) announced its intent to further scrutinize crypto exchanges.

Meanwhile, China continued its crackdown on crypto mining and trading, contributing to market instability. The European Union also made headlines by proposing stricter anti-money laundering rules for crypto transactions.

Technological Innovations

Technological advancements played a crucial role this month. Ethereum’s much-anticipated “London” upgrade went live, aimed at reducing transaction fees and improving the network’s efficiency. Solana emerged as a strong contender in the DeFi space, witnessing a surge in adoption and developer activity.

Market Sentiment

Overall market sentiment remained cautiously optimistic. Despite regulatory pressures, the successful technological upgrades and market recovery trends kept investor confidence intact. Social media platforms saw increased discussions around crypto regulations and breakthrough technologies, indicating sustained interest.

Notable Events

A few key events stood out. The introduction of El Salvador’s Bitcoin Law marked the first instance of a country adopting Bitcoin as legal tender. Additionally, prominent financial institutions like JPMorgan and Goldman Sachs expanded their crypto services, signaling growing institutional interest.

Price Movements

Price movements this month were marked by significant highs and lows. Bitcoin started at $47,000, dropped to $42,000, and ended around $45,500. Ethereum ranged from $3,100 to $3,900, influenced by upgrade news and market sentiment.

Altcoins like Cardano and Polkadot also saw notable gains due to network updates and partnership announcements.The monthly crypto market, with its intense volatility and groundbreaking advancements, requires keen attention to navigate successfully.

Major Market Movements

Cryptocurrencies experienced significant shifts this past month. Price, regulations, and technological advancements influenced market dynamics.

Bitcoin Trends

Bitcoin showed volatile behavior, with prices ranging from $42,000 to $52,000. After hitting a low of $42,000 on September 21st, it rebounded to $52,000 by the month’s end. Elon Musk’s tweets, China’s crackdown, and the US SEC’s pending ETF decisions drove these fluctuations.

Ethereum Developments

Ethereum saw major strides with its “London” upgrade implementation on August 5th. The upgrade introduced EIP-1559, altering transaction fees and reducing ETH supply burn rate, leading to increased scarcity. This move boosted Ethereum’s price past $3,500, though network congestion issues persisted.

Altcoin Performance

Altcoins displayed varied movements. Cardano surged over 30%, reaching $2.80 ahead of its Alonzo hard fork on September 12th, which brought smart contract functionality.

Solana also soared 40%, breaking into the top 10 market cap rankings due to DeFi and NFT applications. Conversely, Polkadot experienced a slight decline, dropping 8% amid network upgrades.

Significant News And Events

Staying informed about significant news and events in the crypto market is crucial. This section delves into key regulatory updates, major partnerships, and influential market figures.

Regulatory Updates

Countries are increasingly focusing on crypto regulations. China continued its crackdown, enforcing strict bans on crypto mining and trading. This led to a significant drop in Bitcoin’s hash rate as miners relocated.

Meanwhile, the U.S. SEC delayed decisions on several Bitcoin ETF applications, citing the need for more stringent investor protections. In Europe, the European Commission proposed stricter regulations on crypto transactions to combat money laundering.

These regulatory shifts affected market sentiment, causing notable price movements and trading volumes.

Major Partnerships And Collaborations

Several partnerships in the crypto space marked significant progress. Visa partnered with over 50 crypto platforms to enable seamless crypto payments through its network.

This move is expected to bolster mainstream adoption. Ethereum saw collaborations with multiple DeFi projects following its “London” upgrade, aiming to enhance scalability and reduce gas fees.

Chainlink partnered with UNICEF to fund blockchain-based applications for social impact, demonstrating the potential of crypto in philanthropy. These collaborations indicate a growing acceptance and utility of blockchain technology in various sectors.

Notable Market Influencers

Key figures significantly influenced market trends. Elon Musk’s tweets continued to sway crypto prices, especially Bitcoin and Dogecoin. His announcements on Tesla’s stance on Bitcoin payments caused immediate market reactions.

Vitalik Buterin, co-founder of Ethereum, provided insights during the “London” upgrade, influencing investor confidence. Social media personalities like CryptoCobain and BitBoy

Crypto garnered large followings, impacting retail investor behavior. These influencers played pivotal roles in driving market sentiment and highlighting emerging trends in the crypto ecosystem.

Market Analysis

Analyzing the crypto market requires a thorough look at price movements, technical indicators, and overall sentiment. This section provides key insights into the current state.

Price Analysis

Bitcoin’s price fluctuated significantly, moving between $42,000 and $52,000. Ethereum’s price surpassed $3,500 following the “London” upgrade.

Altcoins like Cardano and Solana saw substantial gains; Cardano rose by 15%, and Solana surged by 20%. Polkadot experienced a minor decline of 3% due to ongoing network upgrades.

Technical Indicators

Key technical indicators show mixed signals. Bitcoin’s Relative Strength Index (RSI) indicated overbought conditions when it touched $52,000, suggesting a potential correction.

Moving averages revealed a bullish trend for Ethereum, as its 50-day moving average crossed above its 200-day moving average. Volatility indicators for altcoins like Solana and Cardano remained high, reflecting their sharp price movements.

Market Sentiment

Market sentiment shifted mainly due to external factors. China’s regulatory crackdown led to a cautious outlook. The U.S. SEC’s ongoing delays on Bitcoin ETF approvals contributed to market uncertainty.

Positive developments included Visa’s partnerships in the crypto space and increased activity in decentralized finance (DeFi) platforms. Influential figures, including Elon Musk and Vitalik Buterin, continued to sway sentiment through social media and public statements.

Predictions And Future Outlook

Analyzing current trends, I see Bitcoin maintaining its growth trajectory, especially if institutional investments increase. However, sustained regulatory scrutiny might create headwinds. Ethereum’s future looks promising, driven by continued updates and its dominance in the DeFi space.

Altcoins, such as Solana and Cardano, could further diversify the market. As these networks develop, they might attract more projects and users. Polkadot’s interoperability focus positions it well for future growth, contingent on successful network upgrades and partnerships.

Decentralized Finance (DeFi) will likely expand, with more traditional financial institutions showing interest. Adoption rates might accelerate if regulatory environments stabilize. Non-Fungible Tokens (NFTs) could evolve beyond art, impacting industries like gaming and real estate.

Institutional adoption in the crypto space appears set to grow. Companies like Visa entering crypto can encourage more mainstream acceptance. This institutional support can drive significant capital inflows, enhancing market stability and growth.

Market sentiment will continue to shape short-term movements. Influential figures’ statements can drive both positive and negative sentiment shifts. Traders need to stay informed about these influences to navigate the market effectively.

Anticipating future market dynamics, being vigilant about regulatory changes, technological advancements, and market sentiment will be essential. Investors must diversify portfolios and stay updated on developments to optimize their crypto investments.

Ricky Morenolendez is a key contributor at The Digi Chain Exchange, recognized for his deep expertise in cryptocurrency and blockchain technology. With years of experience in analyzing market trends and providing actionable insights, Ricky has become a trusted voice in the crypto space. His work focuses on helping investors understand the nuances of digital assets, from Bitcoin to emerging altcoins. Ricky’s dedication to educating the community on market strategies and crypto developments has made him an invaluable asset to The Digi Chain Exchange team.

Ricky Morenolendez is a key contributor at The Digi Chain Exchange, recognized for his deep expertise in cryptocurrency and blockchain technology. With years of experience in analyzing market trends and providing actionable insights, Ricky has become a trusted voice in the crypto space. His work focuses on helping investors understand the nuances of digital assets, from Bitcoin to emerging altcoins. Ricky’s dedication to educating the community on market strategies and crypto developments has made him an invaluable asset to The Digi Chain Exchange team.