Understanding NFTs: A Brief Overview

Non-Fungible Tokens (NFTs) represent unique digital assets verified using blockchain technology. Unlike cryptocurrencies like Bitcoin or Ethereum, NFTs are indivisible and unique. Each NFT contains distinctive information that makes it different from any other token.

NFTs exist on a blockchain, usually Ethereum, ensuring authenticity and ownership. The blockchain ledger records every transaction, providing a transparent ownership history. This feature makes NFTs appealing for digital art, collectibles, and virtual real estate.

Artists and creators mint NFTs by embedding their digital creations into tokens. This process includes setting properties, metadata, and sometimes incorporating programmable aspects, such as royalties. This novelty ensures artists receive compensation every time the NFT is resold.

NFTs cover various digital assets:

- Digital Art: Platforms like OpenSea showcase digital artworks as NFTs.

- Collectibles: CryptoKitties are virtual cats that can be bought, sold, and bred.

- Gaming Items: Axie Infinity allows players to own and trade in-game assets.

- Virtual Real Estate: Decentraland offers land parcels within the virtual world.

In 2021, NFT sales reached $25 billion, reflecting growing interest and investment. This surge is driven by the desire for uniqueness, the ease of transferring ownership, and the evolving digital economy.

Key Factors Driving the NFT Market Boom

The NFT market shows unprecedented growth. Understanding the forces behind this surge reveals several key factors.

Celebrity Endorsements and Influencer Backing

Celebrity endorsements drive massive public interest. Stars like Snoop Dogg, Grimes, and Mark Cuban have actively promoted NFTs. Influencers, leveraging extensive social media reach, amplify visibility.

For instance, digital artist Beeple collaborated with high-profile figures, boosting NFT awareness. These endorsements legitimize the market and attract new buyers, directly impacting sales volume and market value.

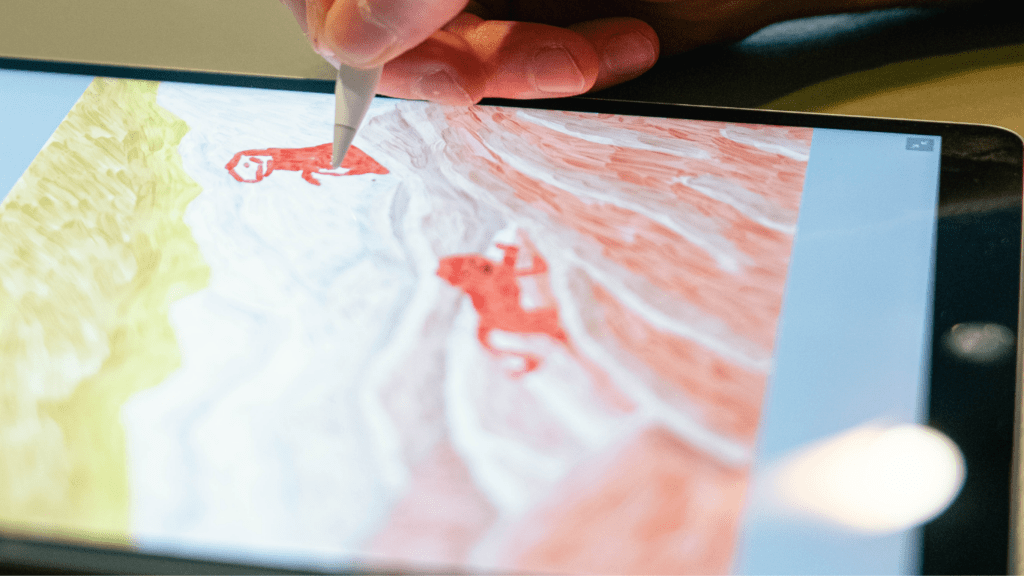

Increased Digital Art Sales

Digital art transactions contribute significantly. In 2021, NFT sales in digital art alone hit record highs, exemplified by Beeple’s $69 million sale at Christie’s auction.

Blockchain ensures provenance and ownership, making it easier for artists to monetize their works. Lower barriers for entry encourage more creators to mint and sell NFTs. This surge in activity drives a higher volume of transactions and fuels overall market growth.

Expansion of Marketplaces

More NFT marketplaces enhance accessibility. Platforms like:

- OpenSea

- Rarible

- Foundation

provide user-friendly interfaces for transactions. OpenSea, one of the largest, lists millions of NFTs, meeting diverse interests from art to music. Greater accessibility through various platforms allows seamless buying and selling. As more marketplaces emerge, they cater to niche segments, promoting wider adoption and market expansion.

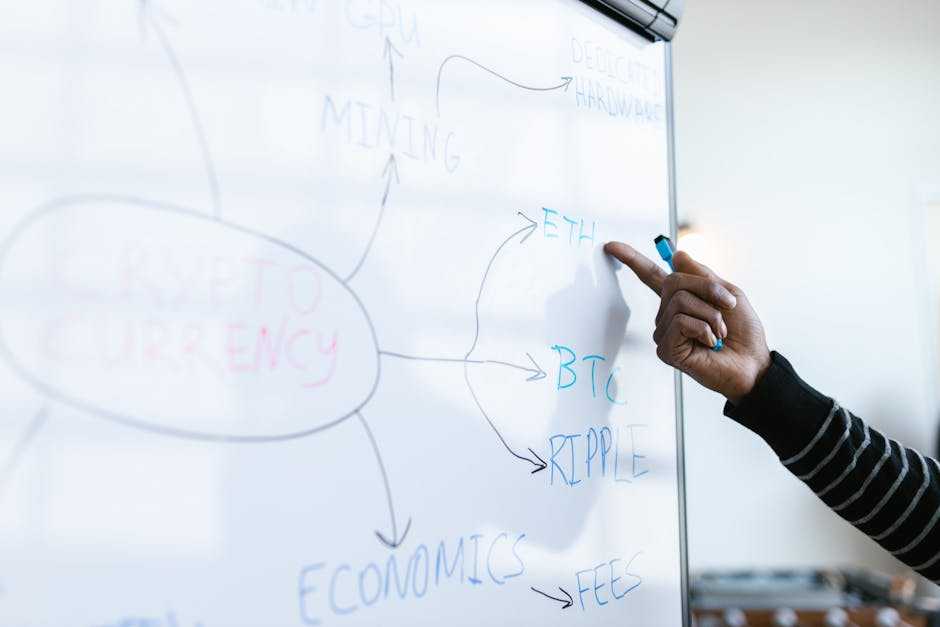

Economic and Technological Drivers

Various economic and technological factors drive the NFT market boom, increasing interest and investment in this digital asset class.

Cryptocurrency Acceptance

Widespread cryptocurrency acceptance significantly boosts the NFT market. Major cryptocurrencies like Bitcoin and Ethereum provide the primary means of transacting NFTs. As more platforms accept digital currencies, NFT trading becomes more mainstream and accessible. For example, OpenSea supports multiple cryptocurrencies, enhancing user flexibility in transactions.

Blockchain Technology Advancements

Blockchain technology advancements fortify NFT security and provenance, attracting more buyers and sellers. Enhanced smart contract functionality allows creators to embed detailed ownership properties, ensuring rightful owner identification. Platforms like Ethereum enable seamless minting and trading of NFTs, improving transaction efficiency and security. This innovation ensures higher adoption rates.

Investor Interest and Speculation

Rising investor interest and speculation contribute to the NFT market’s surge. High-profile NFT purchases gain media attention, drawing more investors looking for lucrative opportunities. Instances like Beeple’s $69 million sale at Christie’s showcase NFTs’ potential value, prompting increased speculation. This heightened interest drives market activity and escalates prices, perpetuating the market boom.

Cultural and Social Influences

Cultural and social forces significantly impact the NFT market surge. Digital collectibles and active communities around them are pivotal factors.

Rise of Digital Collectibles

Digital collectibles gain popularity for their unique nature. NFTs provide a sense of ownership for digital items. Platforms like NBA Top Shot showcase how sports memorabilia evolves into digital formats.

Collectors value limited-edition digital items similarly to traditional collectibles but with blockchain’s security. Celebrities endorsing NFTs also drive attention. Cultural moments, like digital art linked to notable events, become valuable assets.

Community and Fandom Engagement

Community engagement bolsters the NFT market. Social media platforms facilitate discussions around new drops and project developments. Discord servers and Twitter spaces create active and engaged communities.

Fans invest in NFTs to support favorite creators and projects. Exclusive content and experiences included with NFTs add to their appeal. Fandoms feel more connected to artists and brands, strengthening loyalty. This engagement translates to higher demand, driving market growth.

Risks and Challenges in the NFT Market

The NFT market, while booming, faces significant risks and challenges. These issues impact investors, creators, and the environment.

Market Volatility

NFT prices can fluctuate wildly. Market speculation often drives these changes, causing prices to soar or crash within short periods. High-profile sales may attract investors, but sudden drops can result in significant financial losses.

For example, NFT sales like Beeple’s “Everydays” garner millions, yet many pieces see drastic devaluation post-auction. This volatility reflects broader crypto market trends, adding another layer of risk. New entrants may find it daunting to navigate these unpredictable waters.

Environmental Concerns

Producing NFTs consumes considerable energy. The blockchain technology underlying NFTs, especially Ethereum, requires extensive computational resources.

Each transaction, minting process, or sale adds to the carbon footprint. For instance, artist Memo Akten calculated that a single NFT transaction can consume energy comparable to an EU resident’s monthly electricity usage.

The environmental impact has sparked debates and pushed some platforms to explore eco-friendly alternatives. Transitioning to more sustainable blockchain options like proof-of-stake could mitigate these concerns, but widespread adoption remains a challenge.

Future Prospects of NFTs

The momentum behind NFTs isn’t likely to fade anytime soon. Their potential to revolutionize various industries suggests a promising future.

Potential for Mainstream Adoption

NFTs have the capability to integrate into mainstream sectors. In sports, athletes and teams create digital collectibles or event experiences.

Music artists use NFTs to distribute songs, albums, and exclusive content directly to fans. The gaming industry leverages NFTs for in-game assets, providing verifiable ownership and trade between players. Real estate can benefit from tokenized properties, simplifying investments and transfers.

Corporations are increasingly exploring NFTs for branding and marketing strategies. For example, companies mint branded collectibles or offer exclusive access to products and events.

Educational institutions consider using NFTs for issuing tamper-proof academic credentials. The adoption of NFTs in these fields highlights their versatility and extensive potential.

Emerging Trends and Innovations

Innovations within the NFT space are shaping its evolution. Layer 2 solutions on Ethereum, like Polygon, address scalability and transaction fees, making NFTs more accessible.

Cross-chain interoperability allows NFTs to transfer seamlessly between different blockchain platforms. This enhances liquidity and broadens market reach.

Augmented reality (AR) and virtual reality (VR) technologies integrate with NFTs to create immersive experiences. For instance, virtual galleries and events enable users to interact with digital art and assets in new ways.

Fractional ownership platforms let individuals own and trade fractions of high-value NFTs, democratizing access to expensive digital assets.

Social tokens, tied to influencers or communities, are gaining traction. They grant holders access to exclusive content, governance rights, or rewards. This strengthens community bonds and fosters deeper engagement.

The convergence of NFTs with decentralized finance (DeFi) opens avenues for NFT-backed loans and yield farming, increasing financial utility.

These emerging trends illustrate the dynamic and innovative nature of the NFT market. As technologies advance and use cases expand, NFTs will likely continue their upward trajectory, influencing diverse sectors and reshaping digital ownership paradigms.

Ricky Morenolendez is a key contributor at The Digi Chain Exchange, recognized for his deep expertise in cryptocurrency and blockchain technology. With years of experience in analyzing market trends and providing actionable insights, Ricky has become a trusted voice in the crypto space. His work focuses on helping investors understand the nuances of digital assets, from Bitcoin to emerging altcoins. Ricky’s dedication to educating the community on market strategies and crypto developments has made him an invaluable asset to The Digi Chain Exchange team.

Ricky Morenolendez is a key contributor at The Digi Chain Exchange, recognized for his deep expertise in cryptocurrency and blockchain technology. With years of experience in analyzing market trends and providing actionable insights, Ricky has become a trusted voice in the crypto space. His work focuses on helping investors understand the nuances of digital assets, from Bitcoin to emerging altcoins. Ricky’s dedication to educating the community on market strategies and crypto developments has made him an invaluable asset to The Digi Chain Exchange team.