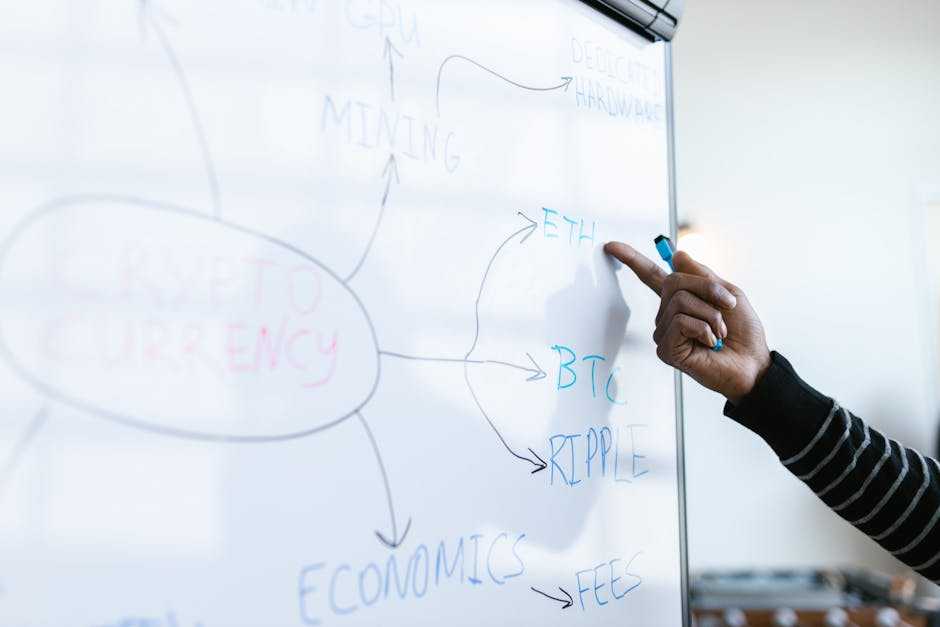

Overview of New Regulations

Regulations focus on enhancing transparency and reducing fraud in crypto and NFT markets. Governments introduce Know Your Customer (KYC) requirements. Exchanges must verify users’ identities, aiming to prevent money laundering and illicit activities.

Anti-Money Laundering (AML) rules become stricter. Authorities mandate stringent monitoring of transactions. Entities must report suspicious activities, aligning with global financial standards.

Security protocols see significant updates. Regulators demand robust cybersecurity measures. Companies face audits to ensure compliance, aiming to protect users’ funds and data.

Taxation policies undergo changes. Authorities require detailed reporting of crypto transactions. Individuals must report gains and losses, ensuring tax compliance.

Specific jurisdictions impose unique restrictions. For example, China’s outright ban on crypto transactions contrasts with the U.S.’s regulatory approach, which focuses on integration into existing financial systems.

Immediate Impacts on the Crypto Market

New regulations are rapidly reshaping the crypto market landscape. These changes have immediate effects that investors and traders must navigate.

Price Volatility

Regulatory announcements often trigger substantial price volatility. For instance, when China announced its crypto ban, Bitcoin’s price dropped by 5%. Similar reactions occur when countries introduce or amend crypto regulations. Traders react quickly to perceived threats or opportunities, causing rapid price swings. It’s crucial to monitor regulatory news closely to manage risks effectively.

Investor Confidence

- Investor confidence directly correlates with regulatory clarity.

- Clear, consistent regulations can bolster confidence by reducing uncertainty.

- The introduction of KYC and AML rules reassures investors about market integrity and security.

- Conversely, inconsistent or overly stringent regulations can deter investment. For example, India’s fluctuating stance on crypto regulations has led to uncertainty, affecting investor sentiment and market activity.

- Regulations influence market behavior and investor sentiment, shaping the crypto ecosystem’s future.

- Careful analysis of regulatory developments is essential for navigating the evolving crypto landscape.

Changes in NFT Market Dynamics

New regulations significantly impact the NFT market, reshaping various aspects and affecting stakeholders. These changes bring both challenges and opportunities.

Artist and Creator Protections

- Regulations are enhancing protections for artists and creators.

- By requiring marketplaces to implement transparent royalty systems, artists consistently receive their dues on secondary sales.

- A report by CryptoSlam highlights that about 20% of NFT transactions result in secondary sales where royalties apply.

- Since forging digital art is a concern, new standards ensure the authenticity of works.

- Platforms now authenticate content upfront, reducing instances of fraud.

This protects intellectual property rights while maintaining trust in the market.

Marketplace Restrictions

Stricter regulations impose limitations on NFT marketplaces, influencing how they operate. For instance, compliance with KYC and AML laws means users must verify their identities before transactions. Statista reports that over 60% of NFT marketplaces now enforce KYC procedures.

These measures aim to eliminate illegal activities, promoting a safer environment. However, they also increase operational costs for platforms, potentially leading to higher transaction fees for users. Marketplaces are adapting by integrating sophisticated compliance tools, which might limit the entry of smaller players due to increased costs.

Long-term Consequences

Innovation and Compliance

New regulations in crypto and NFT markets drive a balance between innovation and compliance. By enforcing regulations like KYC and AML, developers must create compliant solutions without stifling creativity.

For instance, blockchain projects now integrate advanced security features and transparent transaction protocols to meet regulatory standards. Integrating regulatory requirements into technological advancements ensures safer and more reliable market participation.

Developers who innovate within these frameworks promote trust and attract institutional investors. Fintech companies collaborating with regulatory bodies lead the way by offering compliant services and products. Prominent examples include partnerships between blockchain firms and traditional financial institutions.

Market Stability

Regulatory measures contribute to the overall stability of crypto and NFT markets. Clear guidelines reduce uncertainty and enhance investor confidence. Markets experience less volatility as regulatory frameworks solidify, making them more attractive to both retail and institutional investors.

Stable markets foster better planning and risk management. Consistency in legal and regulatory environments allows businesses to strategize long-term investments.

For example, improved market stability insulates investors from abrupt price swings caused by sudden regulatory changes. This gradual stabilization attracts more participants, leading to market growth and maturity.

Expert Opinions

Regulatory Changes Shape Market, Says John Smith, Crypto Analyst

John Smith, a seasoned crypto analyst, asserts that regulations bring both challenges and opportunities. He emphasizes that compliance requirements enhance legitimacy, driving away bad actors. Smith states that institutional investors now feel more secure entering the market, given the reduced risk of fraud.

Jane Doe, Blockchain Developer, Highlights Innovation

Jane Doe, a leading blockchain developer, observes that regulatory pressures are spurring innovation. Developers are creating more sophisticated, compliant solutions.

She mentions that new security features and transparent protocols are attracting significantly more institutional investors. According to Doe, this trend is transforming the industry’s landscape.

Market Stability Improved, Notes Emily White, Financial Advisor

Emily White, a financial advisor, remarks that market stability has improved. With stricter regulations, volatility has decreased, allowing better risk management and planning.

White points out that this stability enhances investor confidence. She believes that the market’s maturity is a positive outcome of these regulatory measures.

Collab Advocates Compliance, Supports Growth

The crypto advocacy group, Collab, praises the regulatory updates for promoting safer market environments. They argue that these measures create growth opportunities by fostering trust and credibility. Collab urges continued dialogue between regulators and industry stakeholders to ensure balanced developments.

These expert insights reveal the nuanced impact of new regulations on the crypto and NFT markets, showcasing both the challenges and benefits brought about by these changes.

Ricky Morenolendez is a key contributor at The Digi Chain Exchange, recognized for his deep expertise in cryptocurrency and blockchain technology. With years of experience in analyzing market trends and providing actionable insights, Ricky has become a trusted voice in the crypto space. His work focuses on helping investors understand the nuances of digital assets, from Bitcoin to emerging altcoins. Ricky’s dedication to educating the community on market strategies and crypto developments has made him an invaluable asset to The Digi Chain Exchange team.

Ricky Morenolendez is a key contributor at The Digi Chain Exchange, recognized for his deep expertise in cryptocurrency and blockchain technology. With years of experience in analyzing market trends and providing actionable insights, Ricky has become a trusted voice in the crypto space. His work focuses on helping investors understand the nuances of digital assets, from Bitcoin to emerging altcoins. Ricky’s dedication to educating the community on market strategies and crypto developments has made him an invaluable asset to The Digi Chain Exchange team.