Navigating the dynamic landscape of the cryptocurrency sector unveils a tapestry of growth patterns that captivate both investors and enthusiasts. The world of crypto, with its ever-evolving trends and market fluctuations, offers a fascinating insight into the future of finance. As I delve into the intricate web of data and analysis, I uncover the compelling narratives that define the trajectory of this burgeoning industry.

Exploring the nuances of crypto sector growth unveils a mosaic of opportunities and challenges that shape its trajectory. From the meteoric rise of certain digital assets to the regulatory developments that reverberate across markets, understanding these growth patterns is paramount for anyone looking to grasp the pulse of the crypto world. Join me on this exploration as we decipher the trends and insights that underpin the captivating realm of cryptocurrency growth.

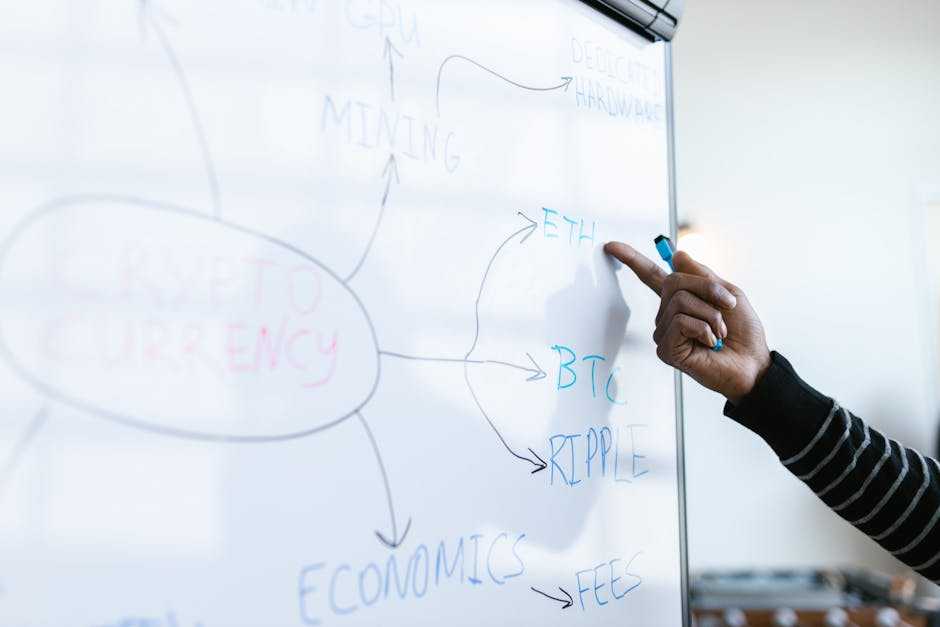

Overview of the Crypto Sector Growth

Exploring the crypto sector reveals a dynamic landscape that continually evolves, presenting intriguing trends and fluctuations that captivate both investors and enthusiasts. Understanding the growth patterns within the cryptocurrency sector is crucial as it encompasses the surge of specific digital assets and the significant influence of regulatory changes. Delving into these insights and trends offers a glimpse into the future of finance within the cryptocurrency domain.

Historical Analysis

In analyzing the historical growth patterns of the crypto sector, early trends and key milestones play a crucial role in understanding its evolution.

Early Growth Trends

Exploring the early growth trends in the crypto sector reveals the initial stages of adoption and innovation. During these formative years, digital currencies like Bitcoin and Ethereum began to gain traction, paving the way for a decentralized financial ecosystem. Interest from tech-savvy individuals and early adopters played a crucial role in laying the foundation for the broader acceptance of cryptocurrencies as a legitimate asset class. Their early support helped drive innovation and build trust in digital currencies. This evolution also led to the development of user-friendly tools that simplify crypto transactions, including the ability to easily convert assets like AVAX to USD.

Key Milestones

Examining the key milestones in the development of the crypto sector unveils pivotal moments that shaped its trajectory. Events such as the creation of the first cryptocurrency, the launch of major exchanges, regulatory advancements, and mainstream adoption initiatives are notable milestones that have propelled the industry forward. These milestones not only reflect the resilience of the crypto sector but also demonstrate its adaptability to evolving market dynamics and regulatory landscapes.

Factors Influencing Growth Patterns

Market Volatility

Cryptocurrency market volatility is a key factor influencing growth patterns in the crypto sector. Fluctuations in prices can impact investor sentiment and trading volumes. For example, sudden price surges or drops in major digital assets like Bitcoin can signal market trends and attract new participants or cause existing investors to adjust their strategies. Understanding and analyzing market volatility is essential for monitoring and predicting growth patterns in the cryptocurrency sector.

Adoption Rates

Adoption rates of cryptocurrencies play a crucial role in shaping growth patterns within the crypto sector. The increase in global adoption by businesses, institutions, and individuals signifies growing acceptance and integration of digital assets into mainstream financial systems. Factors such as user-friendly interfaces, secure platforms, and regulatory clarity can influence adoption rates and drive further growth in the cryptocurrency space. Monitoring adoption trends can provide valuable insights into the future trajectory of the industry.

Regulatory Developments

Regulatory developments have a significant impact on growth patterns in the cryptocurrency sector. Changes in laws, policies, and government attitudes towards digital assets can affect market behavior, investor confidence, and the overall adoption of cryptocurrencies. Clear regulatory frameworks can promote stability and trust within the industry, leading to increased investment and innovation. Keeping abreast of evolving regulations and their implications is key to understanding how growth patterns in the crypto sector may evolve in response to changing legal landscapes.

Impact of Regulation

Exploring the impact of regulations on the cryptocurrency sector unveils a crucial aspect shaping its growth trajectory. Regulatory developments play a significant role in influencing market dynamics and investor behavior, affecting the overall stability and innovation within the industry.

Key Points:

- Regulatory clarity: Clear regulatory frameworks provide a sense of security and legitimacy for investors, fostering trust in the market.

- Compliance requirements: Adhering to regulatory standards ensures transparency and accountability, safeguarding against illicit activities.

- Market response: Regulatory changes often prompt fluctuations in crypto prices and trading volumes as market participants react to new policies.

- Innovation constraints: Overly restrictive regulations can stifle innovation and hinder the development of new technologies and financial products.

- Global impact: Regulatory decisions in one jurisdiction can have ripple effects globally, highlighting the interconnected nature of the crypto market.

Understanding the intricate relationship between regulations and the cryptocurrency sector is essential for investors, businesses, and policymakers alike. By navigating the evolving regulatory landscape with adaptability and foresight, the industry can continue to thrive and innovate in a sustainable manner.

Future Growth Prospects

Exploring the future growth prospects of the cryptocurrency sector unveils a landscape ripe with opportunities and challenges. As the industry continues to evolve, several key factors will shape its trajectory in the coming years.

- Technological Advancements: Enhancements in blockchain technology and scalability solutions will drive innovation within the crypto space. Projects focusing on increasing transaction speeds and reducing costs are likely to gain traction, improving the overall efficiency of digital asset transactions.

- Institutional Adoption: The increasing involvement of institutional investors and traditional financial institutions in the crypto market signals a maturing industry. Institutional adoption brings greater liquidity, stability, and mainstream acceptance, fostering long-term growth and legitimacy.

- Regulatory Developments: Clear and supportive regulatory frameworks will play a pivotal role in shaping the future of the cryptocurrency sector. Balanced regulations that ensure investor protection without stifling innovation are crucial for sustained growth and widespread adoption.

- Global Integration: The global interconnectedness of cryptocurrency markets will continue to influence growth patterns. Cross-border transactions, international collaboration on regulatory standards, and evolving market dynamics across different regions will shape the industry’s expansion.

- Market Maturation: As the crypto market matures, we can expect increased diversification of digital assets, sophisticated trading tools, and enhanced risk management mechanisms. These developments will attract a broader range of investors and contribute to the sector’s overall stability.

- User Experience Enhancement: Improving user experience through intuitive interfaces, enhanced security measures, and seamless interactions will drive mass adoption of cryptocurrencies. User-friendly platforms and applications will make digital assets more accessible and user-friendly for a broader audience.

- Decentralized Finance (DeFi) Expansion: The growth of decentralized finance platforms will continue to disrupt traditional financial services, offering innovative solutions in lending, borrowing, and asset management. DeFi’s expansion presents new avenues for financial inclusion and opportunities for yield generation.

Considering these factors, the cryptocurrency sector is poised for continued growth and evolution. By staying informed and adapting to changing trends and developments, stakeholders can navigate the complexities of this dynamic industry and capitalize on the abundant opportunities it presents.

Ricky Morenolendez is a key contributor at The Digi Chain Exchange, recognized for his deep expertise in cryptocurrency and blockchain technology. With years of experience in analyzing market trends and providing actionable insights, Ricky has become a trusted voice in the crypto space. His work focuses on helping investors understand the nuances of digital assets, from Bitcoin to emerging altcoins. Ricky’s dedication to educating the community on market strategies and crypto developments has made him an invaluable asset to The Digi Chain Exchange team.

Ricky Morenolendez is a key contributor at The Digi Chain Exchange, recognized for his deep expertise in cryptocurrency and blockchain technology. With years of experience in analyzing market trends and providing actionable insights, Ricky has become a trusted voice in the crypto space. His work focuses on helping investors understand the nuances of digital assets, from Bitcoin to emerging altcoins. Ricky’s dedication to educating the community on market strategies and crypto developments has made him an invaluable asset to The Digi Chain Exchange team.